[10/30 업데이트 내용]

카드 명의는 배우자, 휴대폰 어카운 명의는 제 명의입니다

1. 9/14 배우자 이름으로 카드 신청

2. 9/25 카드 메일 수령

3. 9/25 카드 받자마자 바로 ONLINE ACCOUNT 로 연결하고 ACTIVATE. 하지만 OFFER LINK 보이지 않음

4. 9/27 드디어 온라인 계정에 OFFER LINK 가 떠서 ATT.COM 에서 FULL PRICE, OVERNIGHT SHIPPING (총 $824.94) 계산

5. 9/28 아이폰 6S 배송 이메일 컨펌

6. 9/29 아이폰 6S 수령

7. 9/30 기타지출 약 $2000

8. 10/8 멤버십 FEE $95 부과

9. 10/8 $650 크레딧 받을 것 + 연회비 $95 제외한 나머지 금액 모두 결제

10, 10/9 FAX 로 1차 영수증 송부

11. 10/16 FAX 로 2차 영수증 송부 (동일서류)

12. 10/23 FAX 로 3차 영수증 송부 (동일서류)

**$650+95 , 요금 내기전에 빨리 돈 받고 어카운 닫으려고 매주마다 보냈습니다.. ㅎㅎ

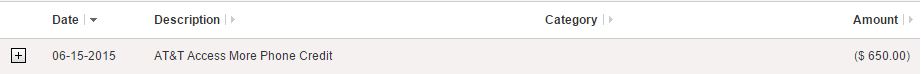

13. 10/30 FAX로 보내려다 $650 크레딧 확인 !

참고로 $650 CREDIT 을 쓰시려면 두가지 방법이 있습니다

1. 시티 계정에서 바로 연결되는 OFFER LINK 사용 (절대로 ATT.COM 개별로 들어가셔서 구매하시면 안됩니다)

2. 오프라인 매장으로 직접 가서 구매 후, 증빙자료 (구매 영수중, CITI ATT 카드번호, 개통한 전화번호) 를 FAX 866-799-5591 로 보내면 알아서 CALL BACK 을 해준다고 합니다

---------------------------------------------------------------------------------------------------

[6/18 업데이트 내용]

우선 결론적으로 말씀드리면, $650 CREDIT 받았습니다.

많은분들이 온라인 링크에서 진행이 안되시는 것으로 알고 있습니다.

문의사항이 있으실 경우 우선 카드회사로 전화하셔도 일반 직원들은 잘 모르며, 무조건 SUPERVISOR 랑 통화하겠다고 양해를 구하고 통화를 하시면 됩니다.

저같은 경우에는, SUPERVISOR 와 통화 했더니, 일단 매장으로 가서 구매한 후, 구매한 영수증을 FAX # 866-799-5591 로 이름과 연락처를 찍어서 보내면 해결해준다고 하였습니다.

혹시몰라 저는 영수증, 판매했던 담당 직원 명함, att에서 주는 종이, 카드뒷면 (카드번호와 이름이 나오게) 을 같이 스캔해서 보내었습니다.

5/2 3일에 구매해서 보냈었고, 지난날 사용 STATEMENT 가 일주일전에 포스팅 되었습니다. 기기산 가격 포함 일단 STATEMENT 금액은 $2700정도 였습니다.

(기계를 구매한 가격 포함해서 $2000만 이용하셔도 괜찮습니다)

그리고 기다렸더니 오늘 아침에 다음과 같이 CREDIT 이 들어와 있었습니다 :)

혹시 이 카드를 오픈하신 분들께 도움이 되었으면 합니다.

IPHONE 6S PLUS 가 나오면... 배우자 카드로도 열 계획입니다 ㅎㅎ

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

많은 분들이 실질적인 step 을 궁금해하실 것 같아, 이렇게 후기 남깁니다.

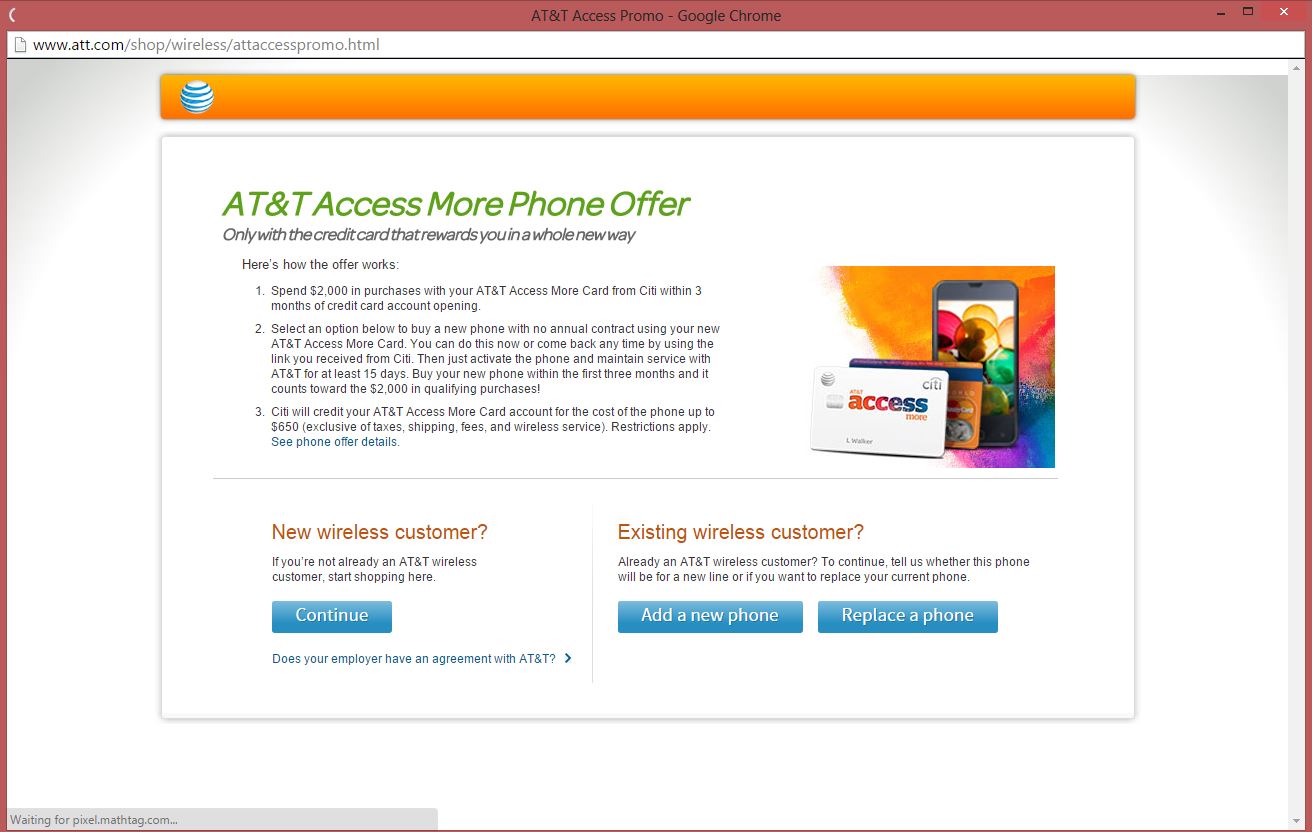

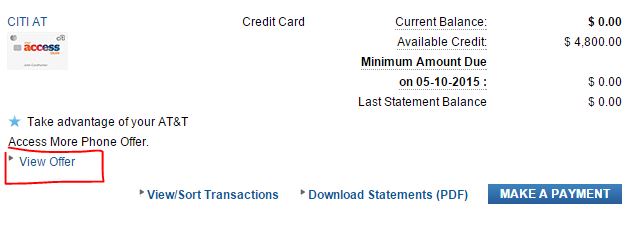

1. 우선 카드 받으시고, 온라인 citibank 아이디 만드시고 로그인 하시고 나면 다음과 같이 뜹니다~

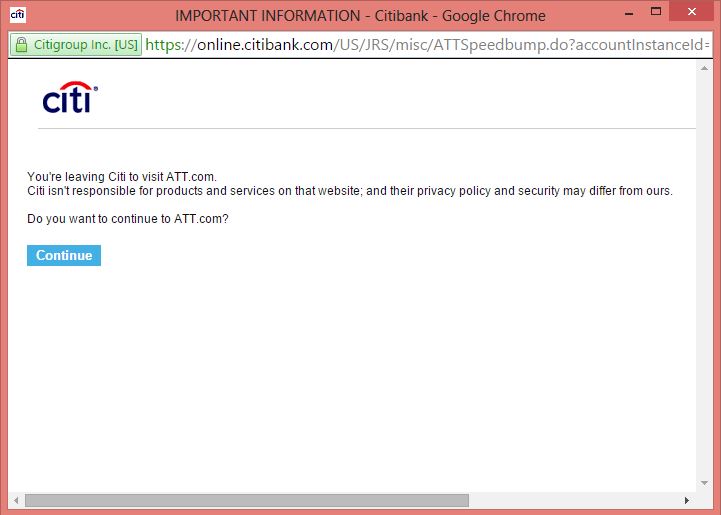

2. VIEW OFFER 누르시고 나면.. 이제 다음과 같이 팝업이 뜹니다~

3. CONTINUE 누르시면 자동으로 ATT 홈페이지로 연결이 됩니다~

새폰 필요하신 분들, 카드는 오픈할 때는 됬는데 마땅한 카드가 없으신 분들, 이번이 기회 아닐까요 ~?

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

AT&T Access More Card from Citi

Make It Your First Reward:

A New Phone!

Get it now or later — it’s up to you.

Here’s how the phone offer works:

- Spend $2,000 in purchases with your AT&T Access More Card within 3 months of account opening.

- Use your card, now or later, to buy a new phone from AT&T, at full price and with no annual contract.

- Make your phone purchase using your unique phone offer link (which will be provided to you), activate and maintain service with AT&T for 15 days. If you buy a new phone now it will count toward the $2,000 in qualifying purchases!

- Citi will then credit your AT&T Access More Card account for the cost of the phone up to $650 (exclusive of taxes, shipping, fees & wireless service).

AT&T Access Card from Citi

Earn 10,000 Bonus Points

redeemable for $100 in gift cards

and 2X ThankYou® Points

for purchases at AT&T and retail and travel websites.

Here’s how to earn the bonus points:

- Earn 10,000 bonus points after you spend $1,000 in purchases within 3 months of account opening.

- Redeem your bonus points for exciting rewards like gift cards, travel rewards, electronics and more.

Earn 3 points for every $1 spent on products & services directly purchased from AT&T.

Earn 3 points for every $1 spent on purchases made online at retail and travel websites.

Earn 1 point for every $1 spent onother purchases.

Anniversary Bonus Points after you spend $10,000 in the prior cardmembership year.

Earn 2 points for every $1 spent on products & services directly purchased from AT&T.

Earn 2 points for every $1 spent on purchases made online at retail and travel websites.

Earn 1 point for every $1 spent onother purchases.

Or call 1-800-785-8037

Or call 1-800-785-8037

PRICING

For the AT&T Access More Card from Citi: The introductory APR for AT&T purchases is 0.0% for 7 months from date of account opening. After the promotional period ends, the standard variable APR for purchases will apply to unpaid promotional balances and new AT&T purchases. The standard variable APR for purchases is 14.99%, 16.99%, 18.99%, 20.99% or 22.99% based on creditworthiness and also applies to non-AT&T purchases and balance transfers. For the AT&T Access Card from Citi: The standard variable APR for purchases is 13.99%, 16.99%, 18.99%, 20.99% or 22.99% based on creditworthiness and also applies to balance transfers. For both cards: The standard variable APR for cash advances is 25.24%. The variable penalty APR is up to 29.99% and may be applied if you make a late payment or make a payment that is returned. Minimum finance charge $0.50. Cash advance fee — either $10 or 5% of the amount of each cash advance, whichever is greater. Fee for foreign purchases – 3% of the U.S. dollar amount of each purchase. Balance transfer fee — either $5 or 3% of the amount of each transfer, whichever is greater. For the AT&T Access More Card, the annual fee is $95. For the AT&T Access Card, the annual fee is $0.

Other Important Account Information

For AT&T Access More Card: Phone Offer Details

To earn your AT&T Access More Phone Offer credit ("Phone Offer"), you must make $2,000 in purchases in the first 3 months of account opening (which can include your eligible phone purchase). Phone offer is not available if you have had an AT&T Access More Card account that was opened or closed in the past 18 months. Balance transfers, cash advances, account fees, interest and items returned for credit are not purchases.

Eligible Phones: Only phones (smartphones or basic/feature phones) purchased from AT&T at full retail price (no annual contract) through the link provided are eligible. You must activate the phone with qualifying AT&T postpaid wireless service (including voice and data as applicable) and keep the phone, and remain active and in good-standing, for at least 15 days. Excludes phones purchased via a 2-year wireless agreement, pre-paid or AT&T NextSM.

Return/Restocking: If you return the phone within 14 days, you will not be eligible for the credit on the returned phone. Restocking fee up to $35 applies.

Offer Redemption: You must purchase an eligible phone from AT&T with your AT&T Access More Credit Card from Citi (the “Card”) using the Phone Offer Link created individually for you. This link may be accessible to you in several locations including, but not limited to, your approval screen at the time you apply, an email welcoming you to Access More Card membership (if you provide a valid email address) and through your Online Account at citi.com/att. You may redeem the Phone Offer using the link at any time after your Card account opening. Once you have made $2,000 in purchases within the first 3 months of your Card account opening, and purchased and activated your eligible phone, Citi will credit your account for the cost of the eligible phone you purchased up to $650 (exclusive of taxes, fees, shipping and wireless service) within 1 to 2 billing cycles. If you choose to purchase an eligible phone which costs more or less than $650, your credit will equal the cost of the phone or $650, whichever is less.

General Offer Terms: Offer is valid for a one time statement credit up to $650 for one eligible phone, is not transferrable and so long as your card account is open and current, does not expire. Offer is not combinable with other discounts on devices. If you close your account prior to redeeming your credit, the credit is forfeited. Terms subject to change.

General Wireless Terms: Subject to AT&T Wireless Customer Agreement. Credit approval required. Coverage & services not available everywhere. Other Monthly Charges/Line: May include taxes & federal/state universal service charges, Regulatory Cost Recovery Charge (up to $1.25), gross receipts surcharge, Administrative Fee & other government assessments which are not government required charges. Other charges and restrictions apply & may result in termination. Terms subject to change.

For AT&T Access Card: Bonus Points Offer Details

To earn your 10,000 bonus ThankYou Points, you must make $1,000 in purchases in the first 3 months of account opening. Bonus Points offer is not available if you have had an AT&T Access Card account that was opened or closed in the past 18 months. Balance transfers, cash advances, account fees, interest and items returned for credit are not purchases.

Citi ThankYou® Rewards

AT&T Access More and AT&T Access Cards from Citi Terms and Conditions

Citi ThankYou® Rewards is offered to certain cardmembers ("you") at the sole discretion of Citibank, N.A. ("we"), the issuer of your card account ("Card Account"). ThankYou Rewards or any portion thereof may be revised or terminated with 30 days prior written notice. Any revisions may affect your ability to use the ThankYou Points you have already accumulated. If ThankYou Rewards is terminated, you will only have 90 days from ThankYou Rewards termination date to redeem all your accumulated ThankYou Points ("ThankYou Points"). Rewards offered by ThankYou Rewards and the ThankYou Point levels required for specific rewards are subject to change without notice.

For AT&T Access More Card

Unless you are participating in a limited-time offer, you will earn:

- 3 ThankYou Points for every dollar you spend on products and services purchased directly from AT&T.

- 3 ThankYou Points for every dollar you spend on purchases made online at retail and travel websites.

- 1 ThankYou Point for every dollar you spend on other purchases.

For AT&T Access Card

Unless you are participating in a limited-time offer, you will earn:

- 2 ThankYou Points for every dollar you spend on products and services purchased directly from AT&T.

- 2 ThankYou Points for every dollar you spend on purchases made online at retail and travel websites.

- 1 ThankYou Point for every dollar you spend on other purchases.

AT&T purchases are AT&T consumer products and/or services purchased directly from AT&T. AT&T consumer products and services must be purchased from www.att.com,www.telephones.att.com, AT&T owned stores or AT&T customer service centers. Purchases from independent wireless dealers or AT&T resellers are not eligible, unless they are for payment of AT&T service. We do not determine whether AT&T consumer products and/or services are correctly identified and billed to us as qualifying transactions, but we reserve the right to determine which purchases qualify. For the AT&T Access More Card: AT&T purchases made online qualify for only a total 3 points per dollar spent. For the AT&T Access Card: AT&T purchases made online qualify for only a total 2 points per dollar spent. Retail websites are websites that sell goods directly to the consumer through an online website and include department store websites, specialty store websites, warehouse store websites and boutique websites. Travel websites are websites that allow you to book travel and include online travel agencies, hotel websites and airline websites.

We do not determine how merchants or establishments are classified; however, they are generally classified based upon the merchant’s primary line of business. We reserve the right to determine which purchases qualify for this offer. Purchases not eligible to receive the additional ThankYou Points include but are not limited to payment for or to medical services, insurance, taxes and government services, education, charities and utilities.

You may earn ThankYou Points as long as your Card Account is open and current. If your Card Account is closed, you will not be able to earn ThankYou Points and you will lose any accumulated ThankYou Points that have not been transferred to your ThankYou Member Account. Balance transfers, cash advances, convenience checks, returned purchases, disputed or unauthorized purchases/fraudulent transactions, finance charges, Card Account fees, and fees for services and programs you elect to receive through us do not earn ThankYou Points unless otherwise specified.

If you do not already have a ThankYou Rewards Member Account ("ThankYou Member Account"), one will be set up for you. ThankYou Points earned from purchases post to your Card Account at the close of each billing cycle, and at that time we will transfer the ThankYou Points you earned to your ThankYou Member Account. (Bonus ThankYou Points may take one to two additional billing cycles to post to your Card Account.) ThankYou Points are not eligible for redemption until they are transferred to your ThankYou Member Account. ThankYou Points may not be redeemed and may be lost if your Card Account is not open or current.

Your Card Account may be closed based on signs of fraud or abuse relating to the earning or redeeming of ThankYou Points. If your Card Account is closed for any of these reasons, you may not be approved in the future for a Citi Credit Card account.

For the AT&T Access More Card: Earn 10,000 Bonus Anniversary ThankYou Points

At the end of each AT&T Access More Card account membership year (the membership year begins the date you become an AT&T Access More Cardmember and resets each year on that date) you, the primary Cardmember, can earn 10,000 Bonus ThankYou Points after you spend $10,000 or more in purchases on your AT&T Access More Credit Card from Citi. Offer is nontransferable. Bonus points will post to your account 1-2 billing cycles after your account membership year ends.

Additional Information.

Any benefit, reward, service, or feature offered in connection with your AT&T Access Card from Citi may change or be discontinued at any time for any reason, except as otherwise expressly indicated. Citi is not responsible for the products and services offered by other companies.

©2015 Citibank, N.A.

Citi, Citibank, Citi with Arc Design and ThankYou are registered service marks of Citigroup Inc.

©2015 AT&T. All rights reserved.

AT&T and the AT&T logo are trademarks of AT&T Intellectual Property, licensed to Citigroup Inc.