비자와 마스터카드가 미국 retailer들과 수수료 관련 legal dispute을 settle했다는 기사입니다. 신용카드 전반에 타격을 줄 것 같네요. 아래는 블룸버그 기사 인용했습니다. 문제시 삭제하겠습니다.

By Paige Smith

(Bloomberg) -- Visa Inc. and Mastercard Inc. agreed to cap credit-card swipe fees — a deal that US merchants say will save them at least $30 billion over five years — in one of the most significant antitrust settlements ever, following a legal fight that spanned almost two decades.

The deal, which is subject to court approval, also would allow retailers to charge consumers extra at checkout for using Visa or Mastercard credit cards and use pricing tactics to steer customers to lower-cost cards, according to a statement Tuesday from attorneys representing the merchants.

“This settlement achieves our goal of eliminating anti-competitive restraints and providing immediate and meaningful savings to all US merchants, small and large,” Robert Eisler, co-lead counsel for the plaintiffs, said in the statement.

A sticker for Mastercard, Visa and Discover credit cards displayed on a street cart in New York on Oct. 17.

The legal fight over credit card swipe fees dates back to at least 2005 — before both Visa and Mastercard were spun off from the banks that owned them to become publicly traded companies. The fees, also known as interchange, are a key driver of profit for card-issuing banks and they are the primary mechanism used to fund popular rewards programs.

In recent years, merchants have grown increasingly vocal about their opposition to these fees, which typically amount to about 2% of a purchase and totaled more than $100 billion last year. While Visa and Mastercard set the level of these fees, it’s the banks that issue the cards that actually collect most of that revenue.

That means banks including JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. that issue cards with Visa and Mastercard are likely to take a hit with these concessions. JPMorgan, the biggest US bank, collected $31 billion of interchange and merchant processing income last year, leading to total card income of $4.8 billion after it accounted for customer rewards, payments to partner companies and other costs.

“For decades, Visa and Mastercard have used their duopoly to fleece retailers of all sizes,” the Retail Industry Leaders Association said in a statement. The trade group’s members include more than 200 retailers, manufacturers and suppliers, including Apple Inc., Dollar Tree Inc., Starbucks Corp. and Home Depot Inc. “This settlement is a mere drop in the bucket. It proves that merchants deserve injunctive relief, but whether the settlement terms proposed are sufficient to remedy the harm caused by the current interchange system needs to be carefully reviewed.”

Stephanie Martz, chief administrative officer and general counsel of the National Retail Federation, said her organization is also reviewing the terms of the settlement.

“The fact remains that these fees are an unfair business practice that harms merchants and consumers and benefits banks,” she said in a statement.

As part of the settlement, Visa and Mastercard agreed to reduce the swipe fees they charge each merchant by at least 4 basis points for at least three years, lawyers for the retailers said. And, for a period of five years, the average systemwide swipe fee for both networks must be at least 7 basis points below the current average, subject to review by an independent auditor.

Retailers will now be able to charge consumers for using a Visa or a Mastercard card and they’ll be able to adjust their prices based on the cost of accepting different credit cards. That could mean, for instance, that a consumer with a Chase Sapphire Reserve card, which carries the Visa Infinite branding and therefore comes with a higher interchange fee, would be charged more at checkout than a customer using a Chase Freedom Unlimited card.

That should help address a pain point among those merchants who despise Visa and Mastercard’s “honor all cards” rules, which stipulate that if a merchant accepts one of the brands’ cards, then it has to accept all of the brands’ cards. Some retailers have said those rules are behind the surge in interchange fees in recent years because Visa and Mastercard have worked with banks to issue more cards that run on their premium networks, which typically cost retailers more.

“This agreement brings closure to a long-standing dispute by delivering substantial certainty and value to business owners, including flexibility in how they manage acceptance of card programs,” Rob Beard, general counsel and head of global policy at Mastercard, said in a statement.

Merchants will also now be allowed to offer discounts to consumers using cards from a certain bank.

요즘은 서비스 업계가 대대적으로 체질을 바꾸고 있는건가 싶네요. 소비자에게 대놓고 돈 더 내놓으라는 뜻일까요. 요식업계는 강제성 띤 팁 요구, 필요 없을법한 상황에서도 팁 부과, 보험사는 가입 자체도 어렵게 하는 지역도 생기고. 이제는 카드사가 수수료를 소비자에게 부과하려는걸까요. 비지니스들을 살려야 해서 그런거라면 어쩔 수 없지만. 저는 이제사 마일리지에 눈떴는데, 누려보기도 전에 혜택들이 사라지는건가요.

판매자가 카드 수수료를 소비자에게 전가할 수 있게 된다는 것 같습니다. 카드사가 수수료를 소비자에게 부과하는 것은 아니지만 수수료를 소비자가 낸다는 점에서 결론은 같겠네요.

뭐여...ㅠㅠㅠ 앞으로는 데빗카드의 시대가 오는 건가?

저도 이거 보고 난리일세... ㅠㅠ 했는데 말이지요. 어찌될련지...

소설 한 번 써봤습니다: 판매자들이 신용카드 사용에 3%의 수수료를 붙이기 시작한다 -> 소비자들이 서서히 체크카드로 이동한다 -> 돈이 없어도 소비하던 미국 소비자들이 점차 소비를 줄인다 & 이자소득이 줄어든 은행들 실적이 폭망한다 -> 세계경제 대공황이 온다

그럴 가능성은 없을... 전직장 당시 CEO가 금융위기때 이런 말로 불안해하는 직원들을 안심시켰죠. "Never underestimate the spending power of the US consumer!" 미국 경제학계에 아주 유명한 말인 것 같습니다.

동의합니다. ㅎㅎ 일단 크레딧카드 쓰다가 체크카드로 이동하려면 한 두 달치 빚을 갚으면서 이동해야 하는데요. 대부분의 미국 소비자들에겐 정말 너무나 큰 허들이죠.

불가능 해요. 일단 카드빚 없는 사람이 적어요.

진짜 셧다운에 난리날 것 같은데 말이죠....막차 타야하나요ㅠㅠ

근데 이게 실질적으로 가능할까요? 기술적으로야 가능하겠지만, 계산대에 카드 목록을 매번 업데이트 할 수도 없을 것이고 그리 하면 고객은 떨어져 나갈 것이고 ...

근본적인 이유야 이해가 갑니다만, 기술적인 측면에서 실제 시행이 가능할런지는 의문입니다.

만약 식당에서 저짓을 하면 팁 - 카드사용비용 할듯

합니다.

일반 비자는 되지먼 Visa Infinite 카드는 안됨 이러는 가게는 생길 수 있지 않을까요?

그럴 수도 있겠습니다만, 계산할 때마다 카드 뒷면을 주섬주섬 확인해야 하고 이런 번거로움을 소비자들이 참아낼까 싶습니다. 비용 차이가 크다면 몰라도 큰 차이가 아니라면 더더욱 그렇구요.

그간 여러 비지니스들은 대부분 비용이다 생각하고 감수해 왔고, 앞으로도 감수하지 않을까 싶습니다.

카드 등급에 따라 수수료가 다르다는 의견의 근거자료가 있으면 볼 수 있을까요? 그런 일은 없다 알고 있습니다. 아 기사에 그렇게 써져있군요.

Take a $100 transaction at a small restaurant. Currently, if a customer swipes a Visa Infinite card, that would cost the merchant $2.60 in fees, whereas a traditional Visa rewards card would cost it just $2.10, according to rate tables laid out in Tuesday’s settlement.

오래 전부터 알려진 내용입니다. 구체적인 숫자는 영업 비밀이겠습니다만, National Retail Federation에 따르면 소위 말하는 프리미엄 카드들은 최대 4%까지 swipe fee를 받는다고 합니다.

https://nrf.com/blog/10-things-know-about-swipe-fees

Every time a shopper uses their credit card, the merchant pays a fee to process the transaction. These fees average 2.24% of the total transaction but can be as high as 4% for premium travel and rewards cards. The swipe fee rate is set by the card network that collects the fee and then pays it out to the bank that issued the card.

비자/마스터 프리미엄 브랜딩카드 사용시 추가적인 비용이 발생한다고 하니... 아마 아멕스불가 이런식으로 비자 인피니트 불가 이렇게 되지 않을까요?

카드마다 수수료 다르게 하는건 현실성이 좀 없어보이는데 그런 니즈가 많으면 아마 결제기에서 프리미엄 카드는 승인이 안되도록 세팅할수는 있을거 같아요.

예전에도 상점에서 은행으로 나가는 머천피가 자동으로 카드종류에 따라 계산되었습니다.스테이먼트가 정말 복잡해서 머천 직원도 모르더라구요. 아멕스는 비자나 마스터보다 피가 높지요.그래서 가입업소가 아니라고 구라를 좀....

중간 Payment Processing Company 에서 자동으로 계산 가능할것 같긴 합니다. (계산대와 크레딧 카드 네트워크 연결시켜주는 회사)

결제시 공시하고 예로 들어 1불 결제하면 머천트/고객에게 1.05 차지 됐다고 답변이 가는.

고객들은 외식하고 팁내고 물건 사고 텍스 내는것처럼 당연하게 생각할수도 있구요

이제 고객들이 캐쉬백 %외에도 카드 수수료 % 외우고 다녀야겠네요

계산전에 카드 수수료 얼마나 받는지부터 확인하고 결재해야 되는 세상이 되겠군요.

카드사 입장에서는 갑자기 사용량 급감으로 사인업 오퍼를 막 퍼줘야 하는 상황이 되려나요?

사람들이 카드 안 쓰게 되면 오히려 카드 사들은 더 어려워져서 혜택을 늘리게 될 수도 있지 않을까요?

만약에 시행한다면 최소 카드 사용료 얼마에 Card convenience fee $x 같이 소액을 붙이지 않을까 예상해봅니다. $5 이하 안 받는 곳이 있었는데, 최소 금액을 올리면서 수수료도 받을지 모르겠네요.

그냥 제 생각입니다만... 아마도 높은 연회비=많은 혜택이라는 공식이 깨질 것 같아요.

카드 받는 merchant입장에서는 사리가 수수료가 높으니 프리덤으로 긁어라, 아님 돈 더내던지... 라고 하면 누가 사리 쓰겠습니까, 프리덤 긁지. 이게 뭐 $100 미만이면 크게 차이가 안 날지도 모르지만, 1년에 $24,000 정도를 쓴다고 하면, 티끌 모아 큰 부담이 될 것 같은 기분이 ㅠㅠ

제가 사는 동네에서는 이미 카드 결제하면 3%-5% 더 붙이는 레스토랑이 적지 않은데, 이제는 아플은 몇퍼센트, 사리는 몇퍼센트, 이런 짓을 해도 이상하지 않겠네요. 그저 소비자만 사업체 사이에서 등 터지는 자본주의 현실

같은 네트웍을 사용하는데 카드 등급에 따라서 다른 fee를 적용했다는 것도 문제가 있어보이긴 합니다.

결국은 소비자가 누리는 혜택이 merchant에서 온 것이라는 말이 되니까요.

Fee가 같아지면 이 부분을 매꿀 것은 연회비일 것 같은데, 그러면서 또 쿠폰북이 두꺼워지겠군요.

어느 방향으로 갈지 궁금하긴 하네요.

지금까지 미국에 마적단이 있을 수 있던 건 사실상 100% merchant 부담이었다는 데는 이견이 없습니다. 실제로 카드사 입장에선 연회비를 높게 받아도, 연체 없이 꼬박꼬박 돈값고, 철지히 이득되게 카드 쓰는 사람은 수익에 크게 도움이 안 되거든요.

더이상의 쿠폰북은 사양하고 싶은데 ㅠㅠ 지금이라도 온갖 카드 달려야 하나 별 생각이 다 듭니다.

네트웍 차이도 아니고 카드 등급이 높다고 피가 높은건 정말 이해가 안가네요. 카드사 입장에서는 등급높은 카드 있는 사람들이 소비를 더하니까 리테일에서 수수료를 더 부담하라는 논리였을까요? 아니면 등급 높은 카드는 카드사 부담이 크니까?

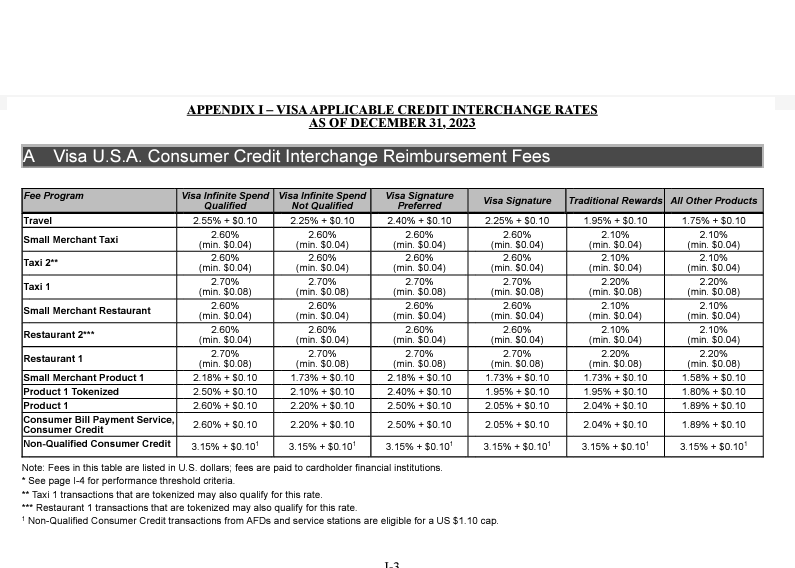

Appendix I 와 J에 비자/마스터카드 등급에 따른 수수료테이블이 있네요.. 대충봤을때 비자/마스터카드가 카드 발행은행에 지불하는 금액인 것 같습니다. 우량고객을 델고온걸 보상하는 형식이랄까요. (수정: 이미지 첨부를했는데 안보이네요)

https://acrobat.adobe.com/link/review?uri=urn:aaid:scds:US:6955340f-78b9-39d5-b1c4-a94cb9e5c41d

카드 등급이 아니라 카드 사용 업종 및 사용형태에 대한 수수료일텐데요? 카드사가 발행하는 카드등급에 따라 구분하는 수수료체계는 표에 없는 것 같은데요. 오로지 비자, 마스터, 아멕스, 디스커버 4개 회사가 카드형대(개인, 기업구매 등), 업종, 거래규모, 및 형태(대면, 비대면 등)에 따라 수수료율이 다를 뿐이죠. 항공사중에 실물카드 보여달라는 경우가 fraud 줄이는 방식으로 거래하면 수수료율이 다르기 때문에 확인하는 것이 그런 대표적 예이고 애플페이가 수수료 먹는것도 비슷한 원리입니다.

이미지가 안올라가서 그런데 밑에 쭉내려가시면 도표가 있습니다... 첨부의 181쪽 Appendix I가 비자 수수료 rate table입니다

row = 업종, 규모, 형태

column = 비자 카드 등급

감사합니다. 보통 보너스 많이 주는 카테고리인 Travel & Dining이 나온 페이지의 카드 브랜드별 수수료 부분만 올려봅니다. 비자는 보통 카드에 비해서 프리미엄 카드가 0.5~0.6% 더 비싸네요.

최대 0.8% 정도까지 차이가 나는 것 같네요. 주유소는 카드 관계없이 동일하다는 점이 흥미롭네요.

저는 이런 체계가 존재했다는 것에 충격받았습니다. 거대기업이 retailer들에게 까라면 까 하고 뜯어간 사례인데, 역시 또다른 거대 기업인 정유사들은 니가 까 그러고 넘어갔었군요^^

1년 반 정도 전의 논의입니다만, 아래의 글을 읽어보시면 swipe fee 관련해서 엄청난 이해관계들이 얽혀 있고 알력들이 존재한다는 점을 아실 수 있을 것이라 생각합니다. 마일 게임 또한 상당한 영향을 받을 것이구요.

https://www.milemoa.com/bbs/board/9526909

이미 크레딧카드 받는 업장에서는 카드마다 수수료가 다 다르니까요. 업주가 사리는 3%, 프리덤은 2%, 데빗은 0.5% 이런식으로 내고는 하죠 (맞는 숫자가 아닙니다, 그냥 프리미엄카드는 더 비싸다는 뜻)

이렇게 점점 크립토 결제의 비중이 늘어날지도..?

아멕스와 디스커버는 해당이 안되나 보죠? 이쪽이 반사이익을 누릴려나요??

문특 궁금한게 하나있는대요. 바클레이 윈댐비즈 카드같은경우 윈댐포인트이긴하지만 8% 를 돌려주는대요. 그럼 주유소들은 카드수수료 8% ?? 정도의 돈을 카드회사에 지불하는건가요?? 어떤주유소들은 현금주유시 조금 겔런당 10센트 정도 깍아주는대도 있지만. 현금가 카드가 같은가격으로 합리적인 기름값으로 장사하는 주유소들도 있거든요. 아님 바클레이가 땅파서 장사하는건지... 궁금해서 여쭤봅니다.

카드수수료 추가로 받는 리테일러들은 꽤 있죠. 컨트렉터, 세금, 유틸리티, 주유소 등등. 근데 카드 등급에 따른 비용이 (예로 2.6% vs 2.1%) 다르더라도 차등화된 수수료를 컨수머에게 전가할 리테일러는 거의 없다 생각하고, 마일게임에 영향도 미미할 것이라 생각합니다.

기사 원문 링크

https://www.bloomberg.com/news/articles/2024-03-26/visa-mastercard-deal-rattles-consumers-credit-card-rewards-math

기사에 인용된 전문가 의견도 비슷하네요.

“Forcing consumers to think about the surcharge, if you’re the merchant, creates a lot of friction at the point of sale, for not that much gain and benefit,” Lulu Wang, an assistant professor of finance at the Kellogg School of Management, said in an interview. “If all you’re saving is a small percentage point for holding up one of your highest paying customers, you’re holding up the line.”

만약에 시행이 된다고 하더라도 레스토랑에서 주문서 발행시마다 수수료를 따로 추가 하는게 아니라, POS 레벨에서 결제에 사용되는 카드 종류에 따라 자동으로 수수료가 추가가 되지 않을까 싶네요. 근데 진짜 저런 0.5%-1%정도의 수수료를 때문에 마일게임이 쉽게 나락으로 가지는 않을거 같다는 생각은 듭니다.

어떤 식당은 카드결재전 영수증하고, 결재후 영수증 금액이 다르게 나오길래 물어봣더니... 6% comfort fee가 붙었다고 하더라구요? 음 그래서 팁을 14%로 줄였답니다?

캠핑 장비나 정비해야겠군요.

댓글 [52]