안녕하세요.

https://coupon.chaseoffers.com/banking/prep.do?ID=0000017415 에서 이메일 입력하시면 이메일로 5월 7일까지 사용할 수 있는 쿠폰 받으실 수 있습니다.

IMPORTANT INFORMATION

*Service Fee: Chase Total Checking® has no Monthly Service Fee when you do at least one of the following each statement period: Option #1: Have monthly direct deposits totaling $500 or more made to this account; OR, Option #2: Keep a minimum daily balance of $1,500 or more in your checking account; OR, Option #3: Keep an average daily balance of $5,000 or more in any combination of qualifying Chase checking, savings and other balances. Otherwise a $12 Monthly Service Fee will apply in most states ($10 Monthly Service Fee for CA, OR and WA).

Chase SavingsSM has no Monthly Service Fee when you do at least one of the following each statement period: Option #1: Keep a minimum daily balance of $300 or more in your savings account; OR, Option #2: Have at least one repeating automatic transfer from your Chase checking account of $25 or more. One-time transfers do not qualify; OR, Option #3: Have a linked Chase Premier Plus CheckingSM, Chase Premier Platinum CheckingSM, or Chase Private Client CheckingSM account. Otherwise a $4 Monthly Service Fee will apply in most states ($5 for accounts opened in CA, FL, GA, ID, NV, OR and WA). A $5 Savings Withdrawal Limit Fee will apply for each withdrawal or transfer out of this account over six per monthly statement period.

We will notify you of changes to your account terms or fees. For more information, please see a banker or visit chase.com/checking or chase.com/savings.

Bonus/Account Information: Checking offer is not available to existing Chase checking customers, those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance. To receive the $300 checking bonus: 1) Open a new Chase Total Checking account, which is subject to approval; 2) Deposit $25 or more at account opening; AND 3) Have your direct deposit made to this account within 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. After you have completed all the above checking requirements, we'll deposit the bonus in your new account within 10 business days. To receive the $150 savings bonus: 1) Open a new Chase SavingsSM account, which is subject to approval. 2) Deposit a total of $10,000 or more in new money into the new savings account within 10 business days of account opening; AND 3) Maintain at least a $10,000 balance for 90 days from the date of deposit. The new money cannot be funds held by Chase or its affiliates. After you have completed all the above savings requirements, we'll deposit the bonus in your new account within 10 business days. The Annual Percentage Yield (APY), for Chase SavingsSM effective as of 2/19/15, is 0.01% for all balances in all states. Interest rates are variable and subject to change. Additionally, fees may reduce earnings on the account. You can receive only one new checking and one savings account opening related bonus per calendar year. Bonuses are considered interest and will be reported on IRS Form 1099-INT.

** Account Closing: If either the checking or savings account is closed within six months after opening, we will deduct the bonus amount for that account at closing.

1Chase QuickDepositSM: is available for select mobile devices. Enroll in Chase OnlineSM and download the Chase Mobile® App. Message and data rates may apply. Subject to eligibility and further review. Deposits are subject to verification and not available for immediate withdrawal. Deposit limits and other restrictions apply. See chase.com/QuickDeposit for details and eligible mobile devices.

2Chase QuickPaySM: Enrollment required. Both parties need U.S. bank account; only one needs a Chase checking account. Transfers between Chase checking accounts will typically be available the same business day and not later than next business day after payment is accepted by recipient. Transfers from Chase checking to a non-Chase account typically take 1-2 business days after payment is accepted by recipient. Transfers from non-Chase account to a Chase checking typically take 4-5 business days after payment is accepted by recipient. Limitations may apply. Message and data rates may apply.

감사합니다.ㅋ...동생이 체이스 오픈할려고 했었는데 공돈이 생겼네요. 감사드립니다.

감사합니다. 세이빙 쿠폰 받으려고 이멜 넣었어요ㅎㅎ

고맙습니다. 제가 사는곳엔 없지만 Chase에 체킹과 세이빙 열어서 혜택좀 봐야겠습니다. 3-4개월정도 유지하고 보너스 캐쉬 받고 클로즈 해도 될까요?

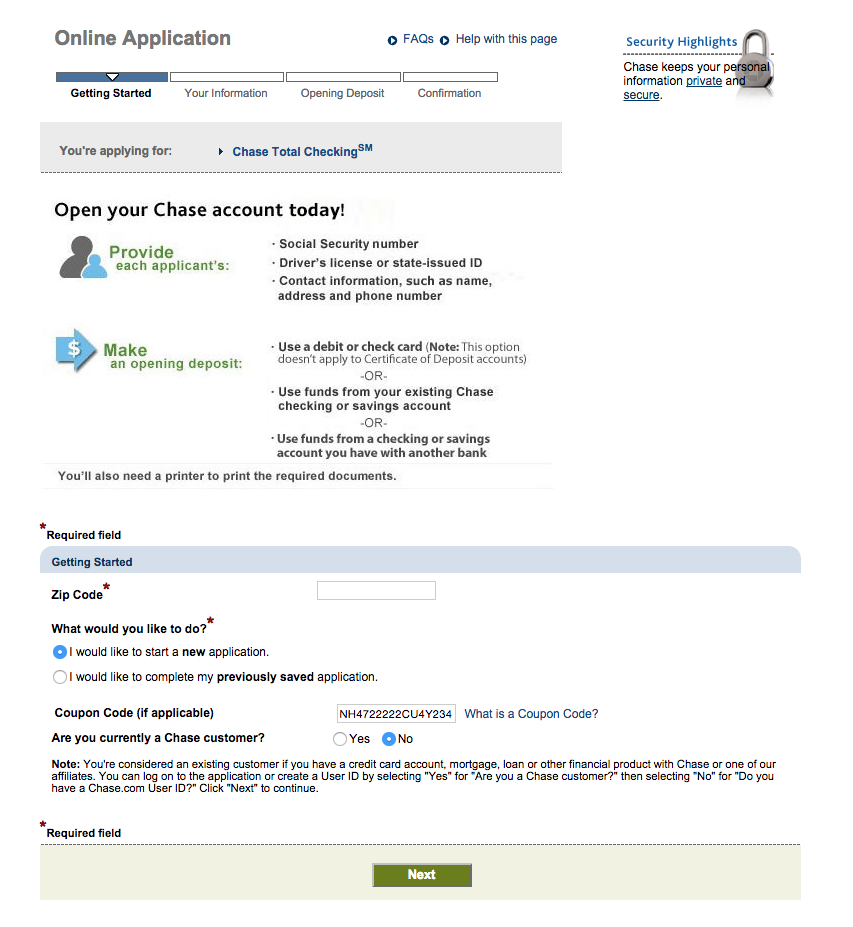

저 사는 곳에도 브랜치가 없어서, 온라인으로 신청해볼려고 하니 ZIP코드 넣으라고 해서 적었더니 다음으로 안넘어가네요. 혹시 온라인으로 신청할려면 다른 지역 번호 넣고 해야되나요? 경험 있으신 분 답변 부탁드립니다.

다른분들은 온라인으로 신청하시는것 같던데...음...저도 잘 모르겠네요~~죄송!!

전 버지니아나 DC에 갈일이 종종 있어서 간길에 브렌치 들려서 오픈하려고 생각중입니다.

https://chaseonline.chase.com/public/oao/GettingStarted.aspx 로 가셔서 해보세요.

아래와 같이 .. zipcode 넣고, 쿠폰 넣으면 되는것 같습니다. 실제 쿠폰 사용은 E-mail 에도 나오지만, 메일 받은후 3시간 이후에 가능한것 같습니다. (E-mail을 12시 38분에 받았거든요)

|

Important Note: You must present the coupon to the banker before the account(s) are opened. This cannot be used for account(s) opened before 3/25/2015 3:38:36 PM |

** Account Closing: If either the checking or savings account is closed within six months after opening, we will deduct the bonus amount for that account at closing.

이 부분 보시면 6개월 이상은 유지해야 된다고 써있네요. 안전하게 6개월 넘게 유지하시다가 클로즈 하는 걸 추천드립니다.

아이고~감사합니다. 제가 글을 잘안읽었네요 ![]()

아 이거 괜찮네요. 다른 분 명의로 온 건 안 먹을 때도 있고해서 쓰기 그랬는데, 감사합니다.

다이렉트 디파짓 될 수 있는 방법으로는 뭐가 있을까요???

duruduru 님꼐서 다른 글 (같은 쿠폰) 에 올려주신 링크 여기에도 넣어둡니다.

------------------------------------------

25불 추가요~! (세이빙 175불)

댓글 [17]