이번 인플레이션 감축(진짜 감축 맞아?) 법안 통과로 전기차 택스 혜택에 대해서 많은 혼동이 있으신 것 같아

자료를 정리해보았습니다.

전기차 관련된 법안은 아래와 같습니다.

참고로 새로운 법안이 통과된게 아닌 기존 법을 Re-Form한 것입니다.

------------------------

수정: 8/16/2022년 12/31/2022년 사이에 주문 & 인도 받은 전기차량은 $ 7500 못받습니다

(*단, Contract Binding이 있으면 받을 수도 있다고 합니다 <= 이부분은 딜러와 상의해보시는 걸 추천드립니다.)

8/16/2022년 바이든 서명 이후로 기존 법안은 사라졌다고 보시면 되겠습니다.

자료 제공해주신 @이성의 목소리님 감사합니다

바이든 서명 (8/16/2022) 이후 2022년에 인도된 차량의 텍스 혜택이 어떻게 되는지 조금 더 찾아본 후에 설명 드리겠습니다.

참고자료

Plug-In Electric Vehicle Credit IRC 30 and IRC 30D | Internal Revenue Service (irs.gov)

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

------------------------

1. 2023년 1월 1일 이후로 배송 받은 차량부터 법안에 적용 됩니다.

예를들면 금일 8/17/2022 테슬라 모델 Y 를 주문했다고 가정해봅시다. 2023년 1월 1일에 인도 받았습니다. 택스 혜택을 받습니다.

예를들면 금일 8/17/2022 기아차 EV6 를 주문했다고 가정해봅시다. 2023년 1월 1일에 인도 받았습니다. 택스 혜택을 못받습니다

2. 현대 기아차는 법안에 해당되나요?

Requires final assembly in North America에서 제조 되어야합니다. 그러므로 7500불 못받습니다.

북미란 캐나다, 미국, 맥시코 및 그 근방의 나라에서 생산되어야합니다. 그러나 현기차는 한국에서 제조되어 수출됩니다.

조지아에 전기차 공장을 지을 예정인데 2025년 이후에나.... 가능할지도..?

3. 미국과 자유 무역 협정을 맺은 나라에서 생산된 배터리를 사용해야합니다.

중국과 일본(협정 논의 중)에서 생산된 배터리를 사용하면 혜택에서 제외됩니다.

현존하는 전기차중 30프로만이 법의 조건을 만족 할 것으로 관측되고있습니다.

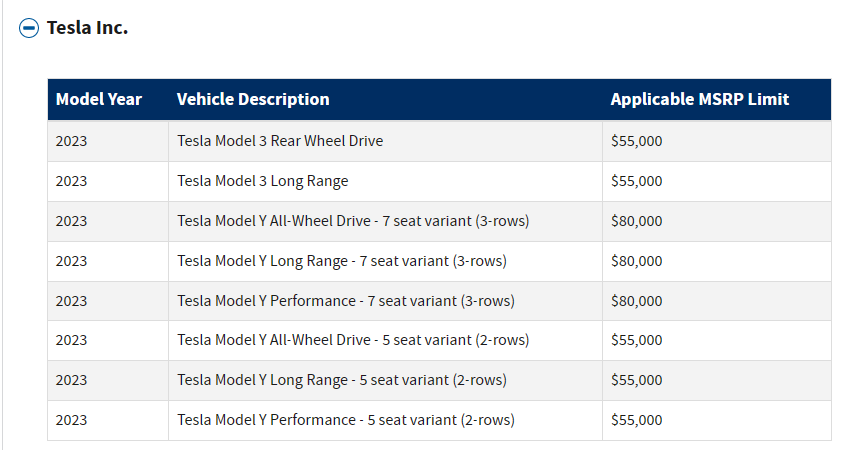

2023년 1월 1일이 후 텍스 혜택을 받는 차량

테슬라 모델 Y 롱렌, 퍼포먼스,

모델 3 롱렌 (가능성 50%) - 2023년 가격을 54,900으로 낮춘다면

모델 3 스탠다드 (가능성 50%) - LFP 배터리가 현재 중국에서 생산되는데 미국에서 생산 시작하면

GM 몇몇 차량

Ford 몇몇 차량

폭스바겐 ID4 -> (가능성 50%) - 몇가지 제조 사실을 소명해야됨

그 외...

2023년 1월 1일 이후 텍스 혜택을 못 받는 차량

현기차 모든 모델 아이오닉5, EV6 등등

포르쉐 모든모델

루시드

리비안 (가격 인하 및 배터리 생산을 미국에서 한다면 혜택 받을 가능성 있음)

아우디 모든 모델

볼보 폴스타

그 외...

Clean Vehicle Credit

Before the Inflation Reduction Act people were able to claim a credit of up to $7,500 for the purchase of a new electric vehicle. Under the new law people still may be eligible for the renamed Clean Vehicle Credit, up to a $7,500 tax credit for purchasing a new electric vehicle and for the first time, people may be eligible for a tax credit up to the lesser of $4,000 or 30% of the sales price for buying a used electric vehicle, depending on their income. Since credits are a dollar for dollar reduction of taxes you owe, you can lower your taxes by up to $7,500 and save money on gas.

Some of the changes related to the Clean Vehicle Credit include:

• The manufacturer limitation is eliminated for cars sold after December 31, 2022

• Requires final assembly in North America

• Manufacturer must be a qualified manufacturer

• Manufacturer’s suggested retail price for vans, sport utility vehicles, and pick ups is limited to $80,000 and other cars are limited to $50,000

• For new cars, modified adjusted gross income cannot exceed $300,000 married filing jointly, $225,000 Head of Household, $150,000 single

• For used cars, modified adjusted gross income cannot exceed $150,000 married filing jointly, $112,500 head of household, $75,000 single

The Clean Vehicle Credit will apply to electric vehicles purchased by December 31, 2032. People who purchased an electric vehicle before the Inflation Reduction Act passed can follow the previous rules in place.

For business owners, the Inflation Reduction Act also adds a tax credit of up to $7,500 for new commercial clean vehicles placed in service after December 31, 2022.

Credit for Electric Chargers Installed at Your Home or Business

Prior to the Inflation Reduction Act a tax credit was available for electric charging stations put in place by businesses and main homes prior to January 1, 2022. The new law extends the credit for charging stations put in service before January 1, 2033.

Energy Credits Available for Your Home

Before the Inflation Reduction Act people were allowed a credit up to 10% of the amount paid for nonbusiness energy property like windows, doors, and skylights and the amount of residential energy property placed in service before January 1, 2022. Now you may take the credit at an increased amount up to 30% if you place the property in service before January 1, 2033.

The provision also eliminates the lifetime credit limit that was previously in place and limits the credit per taxpayer per year.

Credits for Solar Energy

Before the Inflation Reduction Act, if you purchased residential energy efficient property like solar panels and solar water heaters for your home, the tax credit was 26% of your purchase. Under the new law the credit increased to 30% if you purchase the energy efficient equipment January 1, 2022 through December 31, 2032.

Healthcare Tax Benefits

The tax law extends healthcare subsidies if health insurance is purchased in the Health Insurance Marketplace, further extending benefits that were expanded for 2021 and 2022 under the American Rescue Plan. Healthcare subsidies can help lower the health insurance premiums you pay and can also show up as a premium tax credit when you file your taxes if you don’t receive enough subsidy based on your income when you purchase health insurance in the Health Insurance Marketplace. The Premium Tax Credit is generally available to people with households between 100% and 400% of the Federal Poverty Level, but under the American Rescue Plan individuals with income above 400% of the Federal Poverty Level were eligible for the Premium Tax Credit for tax year 2021 and 2022 only. Under the Inflation Reduction Act these benefits will continue.

The law also caps Medicare beneficiaries out-of-pocket expenses for prescription drugs at $2,000 per year and will allow Medicare to negotiate some of the more expensive drugs on the market.

Corporate Tax Changes

Corporations making 1 billion dollars or more will see 15% minimum tax and a tax of 1% of the fair market value on repurchased stock.

Please check back with the TurboTax Blog to find out more information about the Inflation Reduction Act and the most up to date information on the details of what’s included in the bill and what it means to you.

You don’t need to worry about knowing tax law changes. TurboTax will be up to date and you can hand your taxes over to our TurboTax Live tax experts who can fully do your taxes from start to finish.

https://afdc.energy.gov/laws/inflation-reduction-act

| Model Year | Vehicle | Note |

|---|---|---|

| 2022 | Audi Q5 | |

| 2022 | BMW 3-series Plug-In | |

| 2022 | BMW X5 | |

| 2022 | Chevrolet Bolt EUV | Manufacturer sales cap met |

| 2022 | Chevrolet Bolt EV | Manufacturer sales cap met |

| 2022 | Chrysler Pacifica PHEV | |

| 2022 | Ford Escape PHEV | |

| 2022 | Ford F Series | |

| 2022 | Ford Mustang MACH E | |

| 2022 | Ford Transit Van | |

| 2022 | GMC Hummer Pickup | Manufacturer sales cap met |

| 2022 | GMC Hummer SUV | Manufacturer sales cap met |

| 2022 | Jeep Grand Cherokee PHEV | |

| 2022 | Jeep Wrangler PHEV | |

| 2022 | Lincoln Aviator PHEV | |

| 2022 | Lincoln Corsair Plug-in | |

| 2022 | Lucid Air | |

| 2022 | Nissan Leaf | |

| 2022 | Rivian EDV | |

| 2022 | Rivian R1S | |

| 2022 | Rivian R1T | |

| 2022 | Tesla Model 3 | Manufacturer sales cap met |

| 2022 | Tesla Model S | Manufacturer sales cap met |

| 2022 | Tesla Model X | Manufacturer sales cap met |

| 2022 | Tesla Model Y | Manufacturer sales cap met |

| 2022 | Volvo S60 | |

| 2023 | BMW 3-series Plug-In | |

| 2023 | Bolt EV | Manufacturer sales cap met |

| 2023 | Cadillac Lyriq | Manufacturer sales cap met |

| 2023 | Mercedes EQS SUV | |

| 2023 | Nissan Leaf | |

설명감사합니다. 아직도 이해안되는 부분이 있는데요, 예를 들어 2022 9월에 인도 예정 2022 model VW ID.4 를 구입할 경우, TAX credit $7,500 을 받을수 있을까요?

2022년 9월에 인도받으시면, 새로운법안이 아닌 기존 법안을 따르게됩니다.

*** 수정 ***

2022년 8월 16일 전에 계약한 계약서가 있으며 예약금으로 차량 가격의 5% 이상을 지불했던 경우에만 기존 법안 혜택을 받을 수 있을 것 같습니다.

흠.. 미국에서 제조된 EV차량은 바이든대통령이 싸인함과 동시에 법안의 효력이 발생한다고 지난 번에 누가 언급하신 것 같은데..

예를 들면 GM Bolt EV의 경우 Tax Credit을 못 받는 처지이지만, 내년 1월 1일전부터 이미 효력이 발생한다고 얘기하셨거든요..

누구 말이 맞는건가요?? @.@

그러게요. 저도 이렇게 알고 있는데.

저도 효력 발생 시점이 제일 궁금합니다. ㅠ_ㅜ

저는 사실 반대 경운데, 새 법안에 따르면 credit을 못 받는 차이지만 기본 법안에 따르면 받을 수 있는 차를 예약해두고 곧 받을 예정이거든요.

제가 1월 1일부터 아니냐고 댓글로 질문했는데, 대댓글로 quote와 함께 달려서 그런가보다 했던 부분이네요. 실제로 주변에서 그래서 새 법안 사인되기 전에 딜러샵 가서 차 받아온다는 사람도 있다고 들었던것 같습니다. 그래서 개인적으로도 궁금합니다.

Polestar 같은 경우에는 중국에서 제조 밎 생산

즉 오늘 시점부터 7500 텍스 크래딧못받은다고 하네요.

P2 눈 여겨 보고 있었는데 아쉽네요

*Energy Credits Available for Your Home*

Now you may take the credit at an increased amount up to 30% if you place the property in service before January 1, 2033.

올초에 창문 다 갈고 attic insulator 까지 다시 하고 조만간 지붕도 갈예정인데 30퍼센트 택스크래딧 달달 하겠네요 ㅎ

혹시.. 올 초가 아니라 내년 초부터 2033 년 사이 아닐까요? (before 2023 이 아니라 before 2033 이길래요)

아 그렇네요 인터넷 찾아보니 "The credit is revived for the 2022 tax year, and the old rules apply. However, starting in 2023, the credit will be equal to 30% of the costs for all eligible home improvements made during the year. It will also be expanded to cover the cost of certain biomass stoves and boilers, electric panels and related equipment, and home energy audits. Roofing and air circulating fans will no longer qualify for the credit, though. Some of the energy-efficiency standards will be updated as well."

엉엉엉

Plug-In Electric Vehicle Credit IRC 30 and IRC 30D | Internal Revenue Service (irs.gov)

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

이거 보면 final assembly requirement 는 8월 16일부터 바로 적용된다는 것처럼 보이는데요 ㄷㄷㄷ

이게 맞다면 혼란을 막기 위해서 어서 원글님께서 본문을 수정하셔야할 것 같아요.. 저두 그렇게 알고 있었거든요.. 물론 PHEV만 아니라 EV도 포함되겠지만요..

넵!!

용어는 Plug-in EV가 BEV와 PHEV를 포함하는 용어인 것 같더라구요.

https://afdc.energy.gov/vehicles/electric.html

BEVs and PHEVs are also referred to more specifically as plug-in electric vehicles (PEVs).

내년되서 EV6나 Ioniq 5 보조금 빠지고 나면 사는게 좀 쉬워지려나요? EV 판매량만 보면 테슬라, Mach-E 다음으로 이 두 차량이 가장 많이 팔리고 있던데... 아님 다른 나라로 물량 돌리려나요. 여전히 (테슬라 제외) 기존 자동차 회사들 EV 생산 능력이 수요에 한참 못 미치는 분위기 같던데요.

https://electrek.co/2022/08/15/tesla-tsla-dominates-us-electric-car-market-share/

2024년 부터는 살때 부터 7500불을 깍아서 받을 것 같은데 2023년에도 그럴까요? 아니면 23년에는 Tax return을 해주는 걸까요?

ID4 사려고 걸어두었는데 .. 힘들어지겠네요. 모델3 스탠다드가 7500 받을 수 있다면 그게 가장 좋은 선택이 될 것 같네요

맞습니다 2024년 부터는 구매시 즉시 할인 옵션이 생깁니다.

2023년에는 힘들 것 같습니다.

법안 조건에 맞는 자동차 리스팅이 아직 안됐기 때문이죠..

당장 내일모레 $55990에 주문한 테슬라 모델3 받기로 했는데 고민되네요 ㅎㅎㅎㅎㅠㅠㅠㅠㅠㅠㅠ

$55k 세단 가격 리밋이 있을텐데요..

내년에 가격 내릴꺼란 소문이 있어서..ㅎㅎ 보조금 생각하면 예산 내 모델 Y도 들어오구요.. 모델 Y 롱레인지 w/ incentive 랑 제가 주문한 모델3 롱레인지 w/o incentive 가격차이가 별로 안나네요. 이래저래 고민하지만 결국은 차 받을것 같아요 이미 2일 후에 생애 최초 새차를 산다는 마음에 들떠있거든요 ㅎㅎ

머스크형 스타일 보면 가격 더 올리지 싶습니다 ㅎㅎ 가격 올려도 잘만 팔리는데 굳이 보조금 노리고 가격 내릴리가요?

가격 인하 노리고 있다가 가격인상 크리를 맞느냐 vs 가격 인하+7500 보조금 대박을 노리든가

의 외나무다리 데쓰매치군요 ㅎㅎ

조만간 맨체스터 유나이티드 사야하는데 올리겠죠ㅎㅎ

그것은 농담이라고 머씈하게 트윗했슴당..

테슬라 공홈에서 롱렌지 예약 금지로 바꾼거보고 저는 확신했어요.

2023년에 모델 3 롱렌지 54,900으로 가격 내리고 예약 받을 겁니다.

테슬라의 전략은 이렇습니다.

지금 당장 모델 3 롱렌지를 57,900 -> 54,900으로 3천불 내리게되면

기존 예약자들까지 가격을 내려줘야합니다. 또한 예약자들이 2023년 1월 1일 이후로 인도일자를 미루겠죠?

그럼 테슬라에겐 엄청난 손해입니다.

그럼 테슬라에게 가장 좋은 판단은 뭘까?

더이상 예약을 받지않는 것입니다.

예약을 막아두고 올해 예약된 물량을 모두 생산후 인도한 뒤에

가격을 인하 후 다시 예약을 받게되면 기존 고객들과 충돌이 1도 없게 된다는 계산이 떨어지죠

테슬라는 보조금 타먹는 귀신입니다.

올해 8/13 이후 2022년 연말까지 차량 인도 받으시는 분 미국 조립차를 제외하고는 모두 텍스 크레딧 못받습니다. (미국 조립차일지라도 테슬라, GM, 포드, 도요타 못받습니다) 단 8/13일 이전에 구매계약서 (차값 다 지불하고 사인하는 계약서 입니다. 프리 오더 주문서는 해당 안되구요) 가 있으신 분은 크레딧 받을수 있습니다.

물론 2023년 1월 1일 부터는 새로운 법안이 적용됩니다

이거 보고 급 좌절 왔습니다 ㅎㅎㅎㅎ

볼트 고려하고 있었는데,

미국 생산이면 바로 크레딧 적용될거라 해서

기대하고 있었는데 ㅠㅜ

이미 가격을 낮춘 상태인데, 크레딧 까지 받음

고급형도 2만불대 가능한데....

쉐비가 다시 가격 올리지는 않겠죠?

대신에 딜러들이 마크업 붙일 가능성이 농후하다고 봅니다 ㅠ ㅜ

푸딩님 감사합니다. 어제 기어 EV6 계약하면 텍스 7500불 다 받을 수 있다고 해서 계약하고 왔는데 이게 맞다면 딜러측에 뭐라고 항의를 해야할지 ㅠ.ㅠ 그냥 500불 디파짓 낸거 돌려받고 캔슬각인지..ㅠ.ㅠ

차는 다음주 토요일에 픽업하기로 했는데 말예요.... 아쉬워할 피투 (제가 더 아쉽...쿨럭) 의 눈물을 어찌 감당할지...

딜러에서 받을수 있다고 했다면 아마도 사인하신 문서가 binding sales contract 일수도 있습니다. 이게 딜러마다 조금씩 foam 이 다르기 때문에 확답을 드릴수는 없지만 딜러에서 계약 날짜를 어제부로 정했다면 (8/16일이 바이든이 서명한 날인데 이날이 포함되는지는 모르겠습니다) 텍스 크레딧을 받으실 수도 있을것 같네요. 물론 AYOR 입니다.

참고로 만약 어제 사인하신 서류가 binding sales contract 이라면 이미 구입하신거라서 취소하기는 힘들것 같습니다.

계약서를 다시 보니 Retail Installment Sale Contract라고 되어 있네요. 이게 binding sales contract 인가요? 모든 대화를 텍스트로 했는데, deposit refundable 이라고 했거든요. 그리고 federal tax credit eligible 이라고 했구요. 일단 대화 내용은 다 스크랩 해서 계약서랑 함께 저장해뒀습니다.

무쪼록 받을 수 있길... ㅠ.ㅠ

이 계약일 이란게 참 두루뭉실한 것 같아요. 저는 refundable 로 VW ID4에 주문한 상태인데 며칠 전 메일을 받았어요. Contract의 인정범위는 잘 모르겠고 확실치는 않지만 좀 더 안전하게 하려면 딜러싶가서 뭔가를 더 받아라. 그렇지만 그렇다고 그것이 contract로 인정하는 지는 장담할 수 없다.. 뭐 이런 취지로요. 일단은 저는 아직 환불가능하니 기다려 보려구요. 몇 주일 내로 윤곽이 좀더 선명해지지 않을까 기대합니다.

포드는 아직 판매량이 많지 않아 22년 8월 이후에도 Tax Credit 적용 대상인 것으로 알고 있습니다.

IRS Guideline입니다. 8월 16일 이후부터 12/31일까지는 Final assembly requirement를 제외하고는 기존 룰을 따른다고 되어 있습니다.

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

Written binding contract이 있다면 final assembly requirement가 적용이 안된다는 이야기입니다. 밑의 규정을 보면, written binding contract이 있다면 Ioniq5를 8월 16일 이후에 받았더라도, 이전의 규정 즉, final assembly requirement가 적용되지 않게 됩니다.

If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but do not take possession of the vehicle until on or after August 16, 2022 (for example, because the vehicle has not been delivered), you may claim the EV credit based on the rules that were in effect before August 16, 2022. The final assembly requirement does not apply before August 16, 2022.

IRQ website에요.

https://www.irs.gov/businesses/plug-in-electric-vehicle-credit-irc-30-and-irc-30d

이게 테슬라를 올해초에 오더했어도 내년1/1이후에 딜리버리되면 택스크레딧혜택이 가능한걸까요

아님 오더(계약)도 올 8/16 이후에 했어야 받는걸까요

당연히 받을 수 있을 듯 한데요. 다만 테슬라 모델 중 어떤 게 될 거라는 게 좀 불명확해서요.

약간씩 제가 아는 것과 다른 내용이 있어서 도움이 될까 댓글 답니다.

EV/PHEV Credit 관련해서는 Tax Credit을 받기 위한 조건이 적용되는 시점이 3가지 날짜에 따라서 결정되게 되어 있습니다.

1. North America에서 제조되는지 여부: 바이든이 싸인한 8/16일 다음날부터 새로운 법안이 적용됩니다.

2. 배터리의 Requirement를 만족하는지 여부: Secretary of the Treasury가 Guideline을 발표한 이후부터 적용됩니다. 이게 언제 발표될지는 아직 모르고요. 법에는 올해 12/31전까지 Guideline을 발표하게 되어 있습니다. 대부분 예상하기로는 연말 근처에 가서 발표될 걸로 예상들을 합니다.

3. MSRP와 income limitation: 2023년 1월 1일 부터 적용됩니다.

여기서 날짜가 적용되는 것은 차량이 In service 되는 시점 기준이고요. 따라서 Delivery 받는 날짜라고 보시면 됩니다. 예를 들어서 미국 생산되지 않은 EV/PHEV 차량을 8/16일 이후에 Delivery 받았다면 1번에 의해서 새로운 Rule이 적용되므로 $7,500을 받지 못하고요. 미국에서 생산되었고, 배터리 guideline이 발표되기 전에 (언제일지 모르지만) Delivery를 받으면 Credit을 받을 수 있습니다.

그리고, 만약 Binding Contact이 있다면 Delivery 날짜대신에 Contact을 맺은 날짜를 기준 시점으로 삼을 수 있다고 합니다. Binding Contact은 IRS Site에 정의(https://www.irs.gov/businesses/plug-...30-and-irc-30d)가 어제 update되었는데 MSRP의 minimum 5%의 down payment/deposit을 한 경우라고 합니다.

며칠전 딜러샵에 가니 bmw x5 45e 는 지금 오더해도 tax credit 받을 수 있을 거다라고 해서 지금 계약하려고 하는데 (8/22/22 주문 11/1/22 인도받을 예정)

8/16/2022년 12/31/2022년 사이에 주문 & 인도 받은 전기차량은 $ 7500 못받습니다

위에 정리해주신것 보면 크레딧을 못받는 것 같네요 @.@

법안을 잘 읽어봐도 헷갈립니다 ㅠㅜ

딜러아저씨가 잘못 알고 있는게 맞나요?

원글에 나온대로 X5는 미국에서 생산되기때문에 크레딧을 받을수있습니다.

아 그럼 올해 계약하고 올해 인도받아도 크레딧을 받을 수 있다는 말씀이시죠? 저도 법안을 지금 몇번째 읽고 있는지 모르겠습니다. 딜러아저씨는 제가 여러번 물어보니 본인도 잘 모르겠다고 세무사하고 이야기 해보라고 도망쳤습니다...

만약 올해 차를 인도 받으시면 꽝이고 계획대로 내년에 받으시면 크레딧 받을 확률이 높죠.

이거 제가 완전히 반대로 이해하고 있었나보네요. 댓글 수정합니다.

아 그럼 올해 차를 인도받으면 credit 을 못받게 되는게 맞나보네요... 올해 8/16~12/31 사이에 계약하고 인도받는 차 구입에 대해선 너무 헷갈리는게 많습니다 ㅠㅜ

X5 45e는 북미에서 만들고 있기 때문에, 지금 주문하셔서 Treasury Seceratry가 Battery component에 대한 Guideline을 발표하기 전 (언제가 될지는 모르고, 가장 늦은 시점은 올해 12/31)에만 Delievery 받으시면 Tax Credit을 받으실 수 있습니다.

같은 법안을 보는데 저랑 정확히 반대로 이해하고 계시네요. X5 45e 올해 안에 받으면 미국 생산이니 크레딧을 받을 수 있고 내년에는 배터리 성분(?)에 따라서 결정되니 2023년도에 구입한다면 아직 크레딧 미정이라고 보여지네요.

수정: 8/16/2022년 12/31/2022년 사이에 주문 & 인도 받은 전기차량은 $ 7500 못받습니다

(*단, Contract Binding이 있으면 받을 수도 있다고 합니다 <= 이부분은 딜러와 상의해보시는 걸 추천드립니다.)

8/16/2022년 바이든 서명 이후로 기존 법안은 사라졌다고 보시면 되겠습니다.

자료 제공해주신 @이성의 목소리님 감사합니다

바이든 서명 (8/16/2022) 이후 2022년에 인도된 차량의 텍스 혜택이 어떻게 되는지 조금 더 찾아본 후에 설명 드리겠습니다.

참고자료

Plug-In Electric Vehicle Credit IRC 30 and IRC 30D | Internal Revenue Service (irs.gov)

딜러아져씨 말씀 절대로 믿지 마시고 stacker님이 링크 해주신 링크 보시고 판단하세요. 딜러들 거짓말 정말 잘합니다. 지금 리스해커 브로커들이 쓴 글만 보더라도 부정확한 정보로 올해 안에 딜리버리 되면 택스 크레딧 받을 수 있다고 하는 글들 많습니다.

4월달에 22년 X5 45E 오더하고 8월 13일에 23년형 픽업했네요. X5는 23년형이래도 미국서 제조조립하니 헤택 유지 되는거같아 다행입니다.

저같은 경우 3월에 모델Y를 오더했는데 딜리버리가 10월이었습니다. 근데 최근 딜리버리가 12월말에서 1월 초로 바뀌었네요. 이 경우는 제가 12월 이전에 차를 받을경우 택스다덕션이 안되눈거지요? 법이 참 햇갈리네요. 영어로 된걸 읽어봐도 영어를 그리 잘 하는건 아니라 애매모호해요 @,.@

모델 Y의 경우는 북미에서 만들기 때문에 베터리 성분에 대한 Guideline이 발표되기 전에(아마도 올해 말전) 딜리버리 받으시면 tax credit을 받으실 수 있고요. 그 이후가 되면 모델 Y에 들어가는 베터리 성분이 Guideline을 만족하으냐에 따라 받을지 못받을지가 결정됩니다. 추가로 2022년 12/31 이후에 딜리버리 받으시면 인컴과 차량가격에 대한 조건도 적용됩니다.

모델Y는 이미 Tax credit 이 소진 된 것이 아닌가요? 내년에 받아야 credit을 받는 게 아닌가요? 점점 더 알쏭달쏭해지네요

1월에 인도 받으면 7500불 혹은 그 절반을 환급 받을 수 있다고 추측됩니다. 2023년부터 다시 EV tax credit이 주어지니 풀린것이나 다름없는데 문제는 테슬라에서 텍스 크레딧이 굳이 필요없다고 하는 입장이기도 하구요..

그렇군요 결국 내년에나 되야 조금 받을지 말지가 경정이되나보네요. 답변해주셔서 감사드려요

테슬라는 기존 크래딧이 소진되었군요. 이 부분이 고려되면 올해는 못 받고 내년에 배터리 가이드라인에 따라서 받을지가결정되겠네요

기존 법안의 credit을 따라가면 tesla는 이미 credit을 소진하였기때문에, 올해 말 까지는 기존의 act의 budget에서 빠지는거라 못받는게 맞는걸로 이해하고 있습니다. 배터리나 제조 등등은 이번에 새로 발의한 것에서 부수조건으로 기존에 주던 credit 대상의 일부를 제한하자는 내용이지, 기존 act에 돈을 더 지원해주자 는 아니었으니, 내년부터 시작하는 budget에서 나오는 credit으로만 받을수 있을것 같습니다.

이 링크를 보시면 "NOTE: Some manufacturers that have vehicles assembled in North America have reached a cap of 200,000 EV credits used and are therefore not currently eligible for the Clean Vehicle Credit." 라는 말이 있고 tesla 차종들에 note로 표기가 되어있습니다.

오늘 기아 딜러에 아래 글을 보여줬더니..

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before August 16, 2022, see the rule above.

GM 이랑 얘기 후 16일에 사인 한 전 텍스 크레딧을 못 받는 다고 하네요. 캔슬하고 싶음 디파짓 낸 카드 들고 오라네요. 그냥 리펀해준다고요.

피투는 그냥하지 뭐.... vs. Bolt EUV 구매를 할까 고민 중에 있습니다 (당장 9월에 차가 필요해서요 ㅠ.ㅠ)

모델Y는 그럼 내년 배터리 성분까지 고려해서 $3750 받을지 $7500 받을지 두고 봐야하는 것인가요? 소득은 언제 기준으로 되는걸까요

그럴것 같아요. 소득은 전년도 기준이 되야하지 않을까요? 왜냐하면 2024년 이후에는 차를 사는 순간 크레딧을 줘야하기 때문에요.

Nissan Leaf를 2022년에 사는경우 income limit을 넘더라도 (single: $150K, married: $300K) tax credit을 받을수 있는건가요? 2023년에 사는경우는 차량에 관계없이 tax credit을 못받는것 같은데 2022년에 사는 경우에는 어떻게 되는건지 찾아봐도 잘 모르겠네요.

그런 것 같습니다.

다만 vin을 보고 미국생산인지 아닌지만 체크하시면 될 듯 합니다. 아주가끔 미국 생산이 아닌 leaf가 있다고 하더라구요.

감사합니다. 딜러쉽에 있는 차량 vin을 넣어봤더니 미국 생산이라고 하네요.

그나저나 딜이 좀 잘 되나요?

제가 물어봤을 때는 msrp + $5000 부르더라구요 ㅜㅡ

MSRP에 줄 수 있다는 이메일이 오긴 했는데 실제로 그렇게 해줄지는 잘 모르겠습니다. 나중에 딜이 되고 나면 알려드릴께요.

P2와 상의후 안사기로 결정했습니다. 좀 찾아보니 웹사이트에서 MSRP를 딜러 가격으로 광고하는데가 있습니다. 예를 들어 https://www.passportnissanmd.com/new-Marlow+Heights-2023-Nissan-Leaf-S-1N4AZ1BV8PC555429

3만 + 세금 - $7500 이면 대략 2.5만불 OTD정도인 것 같은데요. 한 번 출퇴근에 1갤런정도 소모하는 저에게는 아주 좋은 가격같아 보이는데요, 혹시 안사기로 결정하게 된 계기같은거 여쭤봐도 괜찮을까요? ㅎㅎ 혹시 제가 모르는 단점같은게 있을까 싶어서요.

특별한 이유는 없었구요, 차가 좀 작고 디자인이 마음에 들지 않는다는 점, 그리고 EV credit을 받는다는 보장이 없다는 점 (우리동네ml대장님께서 받을 수 있을거 같다고 해주셨고 저도 그렇게 생각하지만 어디를 찾아봐도 명확한 설명이 없어서 못받을 가능성이 없지는 않아보여서요) 등이 사지 않기로 결정한 이유입니다. 현재 1순위는 시에나입니다.

$7500 은 정말 정말 큰 돈인데 그거에 비해서 확실히 받을 수 있다는건가 없다는건가 뭔가 좀 발끝이 시큼한게 사실입니다.

제가 정말 열심히 뒤져보고서는 받을수 있지 않을까? 하는 생각을 하게 됐구요.

가장 그나마 적법해 보이는 소스는 https://afdc.energy.gov/laws/electric-vehicles-for-tax-credit 입니다.

여튼 저도 msrp에 준다고 하는 딜러가 생기면 다시한번 고민을 해보긴 할 것 같긴 합니다. 지금은 살 것 같긴 하지만 2.5만불이면 사실 엄청난 투자죠.

링크를 보니 40kwh 배터리의 "S" 모델이군요. Leaf standard(40kwh)와 테슬라 3 standard 둘다 약 150마일 레인지 인데요, Tax Credit을 받아서 약 2만5천불을 내고 살 가치가 없다고 생각합니다.

차라리 중고 BOLT(약 22000불 부터 시작)를 사면 range가 260마일인 배터리 새거가 달려있구요(배터리 리콜때문에), 2023 BOLT EV는 약 2만6천불+Tax로 잘 둘러보면 MSRP에 살 수 있습니다.

사람들이 딜리버리를 미루니, 아예 7500을 깍아주는듯요!

https://electrek.co/2022/12/21/tesla-tsla-increases-discount-cars/

헐.. 가뜩이나 주가가 바닥인데.. 이거 참.. 재고가 넘쳐나나 봐요.. hiring freeze에 10% 감원에.. 악재만 무성하군요... (차 사실려고 하는 분들에게는 호재겠지만서두요;;;)

내년에 좀 더 버티면 차값이 더 내려갈까요?

저는 얼마전에 포트 90%이상 테슬라로 바꿨는데요(바꾸자마자 8%두드려맞고 드러누움), 사실 악재뉴스는 아니지않을까요 일주일기다리면 7500크레딧인데 연말 수요가 있는게 더 이상할듯해서요..만약 남은 일주일동안 엄청팔린다면 수요문제가 아니였던거고요 지켜봐야겠네요

저 이번주 차 픽업예정인데 앱에 7500불 디스카운트라고 뜨네요!

아직 모델Y 2023년 인도 차량에 대한 $7,500 택스 크레딧이 어떻게 될지 모르는 상황이죠?

그러면 가능한 12/21-31 기간에 딜리버리를 받는 게 오히려 $7,500 할인을 확실하게 받을 수 있는 찬스로 보이는데,

혹시 제가 놓치고 있는 부분이 있나 모르겠네요. 빠른 결정이 필요할 것 같은데 말이죠 ㅋㅋ

12/21-12/31일 사이에 받는게 가장 좋지 않을까요?

모든건 리스크 테이킹이기 때문에 ㅋㅋㅋ 확실한걸 선택하는게 좋아보입니다!

모호하게 2023 1월 1일 딜리버리받고 테슬라에서 7500불 할인까지 해준다면!?

최고의 시나리오가 나올지도요 ㅎㅎ

다른글에서 @효누 님이 알려주셨는데. 새로운 뉴스가 있네요. https://www.reuters.com/business/autos-transportation/us-release-ev-tax-credit-battery-minerals-component-rule-march-2022-12-19/

그리고 2023 id4가 최근에 리스트에 추가된것 같아요

| 2023 | Rivian R1S | |

| 2023 | Rivian R1T | |

| 2023 | Tesla Model 3 | Manufacturer sales cap met |

| 2023 | Tesla Model S | Manufacturer sales cap met |

| 2023 | Tesla Model X | Manufacturer sales cap met |

| 2023 | Tesla Model Y | Manufacturer sales cap met |

| 2023 | Volkswagen ID.4 |

오늘자로 리스트가 업데이트 되었는데, SUV에 인승 제한이 생긴 것 같습니다.다시 보니 제조사마다 다르네요. ID.4 는 인승 대신 AWD로 갈리네요.

5인승은 MSRP가 55,000 이하여야 적용되네요. 7인승 이상이어야 MSRP 80,000이하가 적용되고요.

예를들어 테슬라 모델Y LR는 5인승 구성이 현재 가격이 65,999라서 적용 제외입니다. 과연 테슬라가 55,000까지 가격 인하를 하게될지....

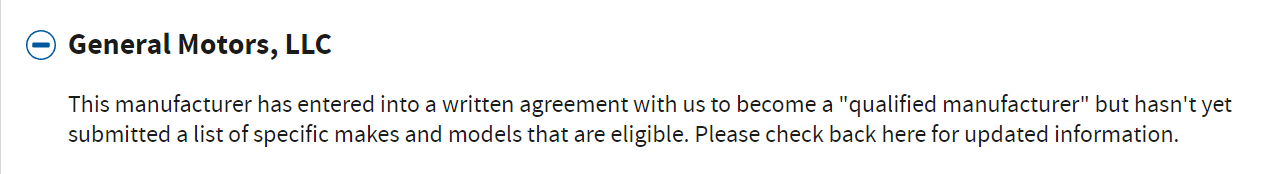

GM 이 하나도 없네요... 제가 예전에 GM 배터리가 중국산 LG 제품인 거 알고 있었는데 하도 언팔을해서 그 사이에 바꾼 줄 알았어요... 그런데 아니었군요...

제가 생각하기에 3월달에 광물 제한 걸리면 보조금 적용받는 차는 한대도 없을 거 같아요. 이 법안은 혜택받는게 거의 로또수준입니다...

아직 GM에서 정보를 업데이트 하지 않아서 없는것 같습니다. 아마 몇일 내로 업데이트 되지 않을까 싶습니다.

말씀하신것처럼 3월달 이후에는 대부분 차량이 requirement를 충족하지 못할 확률은 높아보이네요 ㅠ.ㅠ

저는 세금 혜택이 조금 헷갈리네요.

예를 들어 2023년에 일년동안 제가 낸 세금은 $15000이고, 세금 정산 후 제가 페더럴 택스를 돌려 받아야 할 세금이 $500불이라고 할때 $7500 크레딧을 받을 수 있는 전기차를 사면 저는 $8000을 돌려 받게 되나요? 아니면 $500 인가요?

댓글 [100]