안녕하세요. 구글로 검색해봤는데, 관련된 문서가 안 뜨는 것을 보니까, 아직 아무도 모르는 것 같아서, 마모에 올립니다.

며칠 전에 Chase 홈페이지 들어가보니, PP 카드 혜택이 사라져있길래, 불안해서 Chase customer service에 전화했습니다.

"내 PP 1월 말에 만료인데, 그냥 오늘 하나 새로 발급해서 보내줘" 라고 요청했더니,

"이상하네, PP 카드 발급 옵션이 안 보여." 라는 대답을 들었습니다.

PP 혜택이 없어졌다고 확실하게 이야기하지 않고, 왜 발급 옵션이 안 보이지? 하며 당황하는 것을 보니, 내부적으로도 발표 전인가 봅니다.

요즘 PP 카드야 워낙 흔해서 Ritz가 혜택을 없앤다고 큰 지장이 있진 않지만... 그래도 제가 가지고 있는 PP 중에 제일 좋은 PP였는데 없어진다니 조금 아쉽네요.

(업데이트) 제 계정으로 들어가서 Terms & Conditions 퍼왔습니다.

*For a complete list of your card benefit disclosures, please select the “See all Terms & Conditions” link below.

Please see your Rewards Program Agreement for more information about the rewards program on your credit card.

^These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Please refer to your Guide to Benefits for a full explanation of coverages, or call the number on the back of your card for assistance.

¿Habla español? Esta página contiene información importante sobre los beneficios de su tarjeta de crédito. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

See less Terms & Conditions

6 points per $1 at hotels participating in Marriott Bonvoy:

For more information about The Ritz-CarltonTM Credit Card rewards program, view the latest Rewards Program Agreement.

3 points per $1 on restaurants, car rental agencies and airline tickets:

For more information about The Ritz-CarltonTM Credit Card rewards program, view the latest Rewards Program Agreement.

2 points per $1 on all other card purchases:

For more information about The Ritz-CarltonTM Credit Card rewards program, view the latest Rewards Program Agreement.

Free Night Award:

Please allow up to 8 weeks from your account anniversary date for your Anniversary Free Night Award E-Certificate to be automatically deposited into your Marriott Bonvoy™ Account. Account anniversary date is the date that is twelve months after your account open date, and the same date each twelve months thereafter. Your Anniversary Free Night Award is valid for a one night hotel stay at a property with a redemption level up to 50,000 points. You are responsible for all incidental charges such as parking fees, and payment of mandatory resort fees at properties where resort fees are charged. For the list of participating hotels where you can redeem the 50,000 points, log on to redeem.marriottbonvoy.com/hotels or call the Marriott Bonvoy number on the back of your card. Your E-Certificate may not be combined with cash or other Marriott Bonvoy points when redeeming for your free night, and may not be transferred, extended beyond expiration date, or re-credited for points. Each Anniversary Free Night Award issued will have an expiration of 12 months. To qualify for the Anniversary Free Night Award, your account must be open and not in default on your account anniversary date. Offer and Anniversary Free Night rules and regulations are subject to change. Chase is not responsible for offer fulfillment.

Upgrade your stay:

The Ritz-Carlton Club Level: Club Level offer valid at participating Ritz-Carlton hotels on up to three qualifying paid stays per account anniversary year using The Ritz-Carlton Credit Card with a seven-night maximum length of stay, subject to availability at time of reservation. “Account anniversary year” means the year beginning with your account open date through the anniversary of your account open date, and each 12 months after that. E-certificate is required, is non-transferable, and not combinable with other offers. Club Level Upgrade E-Certificates are valid for 1 room per e-certificate and up to 2 guests per room. Valid only on member rates and non-discounted rates available weekdays and weekends on standard and premium rooms. Not valid on special corporate negotiated rates, wholesale rates, discounts or promotions (includes AAA), packages, group rates, eChannel rates, advance purchase rates and Government rates. Reservation must be paid for with a valid Ritz-Carlton Credit Card. Account must be open and not in default to maintain your Club Level E-Certificates. JPMorgan Chase Bank, N.A. is not responsible for offer fulfillment or the provision of or a failure to provide the stated benefits and services.

Receive 15 Elite Night Credits each year:

15 Elite Night Credits: On or before March 1 of each calendar year, a maximum of 15 Elite Night credits will be credited to your Marriott Bonvoy member account operated by Marriott International, Inc. in accordance with Marriott Bonvoy terms and conditions. To be eligible to receive the 15 Elite Night credits with this Card, you must be the primary cardmember, your Card Account must be open as of December 31 of the prior year, and you must have an active Marriott Bonvoy member account linked to your credit card account. This benefit is not exclusive to credit cards offered by Chase. A maximum of 15 Elite Night credits will be awarded per Marriott Bonvoy program member account even if the member has more than one Credit Card linked to their Marriott Bonvoy account. When your Marriott Bonvoy member accounts are merged, if both accounts have received 15 Elite Night credits, only one 15 Elite Night Credit will remain. Separate promotional offers of Elite Night credits will not count towards this per-account maximum but may have their own limits, see promotional terms at time of offer. Chase is not responsible for offer fulfillment or the provision of or failure to provide the stated benefits and services.

Automatic Gold Elite Status:

Automatic Gold Elite Status: You will automatically receive Gold Elite Status each account anniversary year as a cardmember (“Account anniversary year” means the year beginning with account open date through the anniversary of your account open date, and each 12 months after that). Please allow up to 8 weeks from account open date for your initial Gold Elite Status award to be applied to your Marriott BonvoyTM account. To qualify for and maintain Gold Elite Status your account must be open and not in default. If you do not qualify for Gold Elite status as a cardmember, in order to receive Gold Elite benefits you must qualify for Gold Elite Status under the terms of the Marriott Bonvoy program. Only one Ritz-Carlton Credit Card account per Marriott Bonvoy member (Marriott Bonvoy member must be the primary cardmember on that account), is eligible for the Gold Elite Status award. JPMorgan Chase Bank, N.A. is not responsible for offer fulfillment or the provision of or failure to provide the Gold Elite benefits and services.

Earn Platinum Elite Status:

Platinum Elite Status: Each account anniversary year you make Purchases totaling $75,000 or more you will qualify for Platinum Elite Status through December 31 of the following year. “Account anniversary year” means the year beginning with your account open date through the anniversary of your account open date, and each 12 months after that. Purchases are when you, or an authorized user, use a card to make purchases of products and services, minus returns or refunds. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. Please allow up to 8 weeks after qualifying for the Platinum Elite Status award to be applied to your Marriott BonvoyTM account. To qualify for and maintain Platinum Elite Status your account must be open and not in default. If you do not qualify for this bonus offer, in order to receive Platinum Elite benefits you must qualify for Platinum Elite Status under the terms of the Marriott Bonvoy program. Only one Marriott Bonvoy Credit Card account per Marriott Bonvoy member, (Marriott Bonvoy member must be the primary cardmember on that account), is eligible for the Platinum Elite Status award. JPMorgan Chase Bank, N.A. is not responsible for offer fulfillment or the provision of or failure to provide the Platinum Elite benefits and services.

$100 hotel credit:

$100 Hotel Credit: Hotel credit available at participating The Ritz-Carlton and St. Regis hotels for qualifying paid stays using The Ritz-Carlton Credit Card when booking this offer, and requires a two-night minimum length of stay, subject to availability. Valid only on member rates and non-discounted rates available weekdays and weekends on standard and premium rooms. Not valid on special corporate negotiated rates, wholesale rates, discounts or promotions (includes AAA), packages, group rates, eChannel rates, advance purchase rates and Government rates. Credit is non-transferable or combinable with other offers, consecutive reservations in the same hotel are not valid, and advance reservations are required. Credit must be used during original reservation, no cash back, and may not be applied to room rate or hotel goods or services provided by a third party. Not valid on room rate, alcohol, taxes or gratuities. Reservation must be paid for with a valid Ritz-Carlton Credit Card. Chase Bank USA, N.A. is not responsible for offer fulfillment or the provision of or failure to provide the stated benefits and services.

$300 travel credit:

$300 Annual Travel Credit: To request a statement credit to apply towards qualifying airline incidental purchase(s) made with your Ritz-Carlton Credit Card, you must contact J.P. Morgan Priority Services at the number on the back of your Ritz-Carlton Credit Card within 4 billing cycles of the purchase date. Only the following types of non-ticket purchases qualify for this offer: airline lounge day pass, or towards a yearly lounge membership of your choice; airline seat upgrades; airline baggage fees; in-flight Internet/entertainment; in-flight meals. Purchases are when you, or an authorized user, use a Ritz-Carlton credit card to make purchases of products and services, minus returns or refunds. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. We do not determine whether merchants correctly identify and bill transactions as being of a certain type. However, we do reserve the right to determine which purchases qualify for statement credits. Statement credit will post to your account within 5-7 business days and will appear on your monthly credit card billing statement within 1-2 billing cycles. Qualifying purchases made by authorized users on your account are eligible for statement credits; however, only the obligor on the account, not authorized users, may request statement credits. Maximum statement credit accumulation for this offer is $300 per calendar year. Annual credit will be issued for the calendar year in which the transaction posts to your account. For example, if you pay baggage fees at the end of 2018, and the airline does not post the transaction until 2019, the cost of the baggage fees will be allocated towards your 2019 calendar year maximum of $300. Marriott Bonvoy is not responsible for offer fulfillment or the provision of or a failure to provide the stated benefits and services.

Receive free in-room WiFi:

Premium On-property Internet Access: For primary cardmembers only, available at Participating Marriott BonvoyTM hotels. For details, see marriottbonvoy.com/about. Chase is not responsible for offer fulfillment.

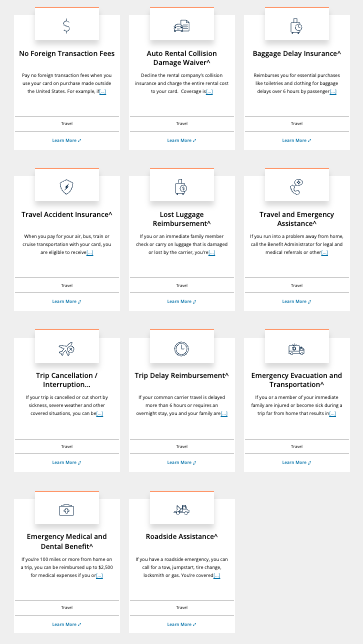

No Foreign Transaction Fees:

See Cardmember Agreement for details.

Fraud Alerts/Automatic Account Alerts:

Delivery of alerts may be delayed for various reasons including technology failures and system capacity limitations. There is no charge from Chase, but message and data rates may apply.

Zero Liability Protection:

Zero Liability Protection does not apply to use of an account by an authorized user without the approval of the primary cardmember. If you think someone used your account without permission, tell us immediately by calling the Cardmember Services number on your card or billing statement.

Adding an Authorized User:

All correspondence, including credit cards, statements, and notifications will be sent to the name and address on file for the primary cardmember. The primary cardmember is responsible for repaying all balances on this account. Authorized users will have the same account number and charging privileges as the primary cardmember but will not be financially responsible. Chase provides account information to the credit reporting agencies for all account users. This information could impact an authorized user’s credit score. When you tell us to add a user to your account, you’re confirming that you have a relationship with the person or people whose name(s), address(es), and date(s) of birth you’ve told us, that all their information is correct, and that you have their consent to add them. If Chase determines you’ve given us fraudulent name, address, or date of birth information, or did not have such consent, Chase can close this account.

안돼!! ㅠㅜ

저도 똑같은 반응이었습니다. ㅠㅠ

욕해도 되나요???? ㅠㅠ

예. 당근이죠. 제 가족 전부 AU로 PP 만들어줬는데... 흑.

할까말까 고민하던 Venture X를 만들어야하는 필연적 이유가 생기는건가요...

전 요즘 한참 새 카드 안 만들었는데, 드디어 Ritz 보내주고 VX 만들어야겠습니다...

앗... 으아니.. ㅠㅠ 그럼 카드 유지할 필요가 없어지는 걸까요.. :(

저도 추이 보고 지금 가지고 있는 쇠로 된 카드 유효기간 끝나면 취소할까 생각 중입니다... 뽀대는 나잖아요. ㅎㅎ

예... ㅠㅠ 근데 제 계정에 들어가서 보니 심지어 Global Entry $100 혜택도 없어졌네요. 본문 업데이트했습니다.

어머.........

그렇게 또 하나의 카드가.. 안녕...ㅠ

오잉 12월1일 AU 카드에 PP신청했는데 그땐 별말 없었는데 이상하네요

글읽고 깜놀해서 제 어카운트 가보니, 정말 안보이네요... ㅠㅠ

이번 월초에 Ritz로 업글하고 3일전에 SM으로 PP 신청했는데.. issue했고 10일안에 받을것이라는 답변을 받았습니다.

참고로 레딧글에 의하면 benefits란에 PP 가 안보이기 시작한지는 좀 된것 같은데 (적어도 넉달) 여전히 PP카드 잘받았고 AU 등록한것에 대해서도 PP 잘받았다고 합니다.

저는 지난달 말에 AU의 기존 PP카드 유효기간 연장된 것으로 잘 받았습니다.

저도 1월 말 만료되는데 오늘 우편으로 2025년까지 연장된 카드가 왔습니다. 따로 연락하지 않았는데 보내줬어요

댓글 [19]