Please be advised that this site includes affiliate links that pay commission and referral links that provide other forms of benefits such miles or points. Should you apply for a credit card and get approved through the links that were provided by this website, it is understood that some form of compensation will be made to the website owner. You can read the full advertiser disclosure here. All information related to credit cards has been collected independently by MileMoa.com and has not been reviewed or provided by the issuers of credit cards discussed here. While the offers mentioned below are accurate at the time of publication, they are subject to change at any time and may have changed, or may no longer be available.

Partner site: learn more about this card

Chase Sapphire Reserve® Credit Card is a premium personal credit card from Chase, which allows you to accrue highly valuable Chase's Ultimate Rewards® Points for all your eligible spendings.

In this posting, I will describe major features of this personal credit card, and then will explain various ways you can redeem your hard earned Ultimate Rewards points.

1. Major Features

Sapphire Reserve® Credit Card has the following major features.

1) Welcome Bonus

After spending $4,000 on purchases in the first 3 months from account opening, you will earn 60,000 Ultimate Rewards points.

If redeemed for statement credits, 60,000 Ultimate Rewards points are valued at $600. But as explained below, you can use 60,000 Ultimate Rewards at a much higher value.

2) $300 Annual Travel Credit

When you use your card for travel purchases (for example, for hotel reservations), you will automatically receive up to $300 Annual Travel Credit in the form of reimbursements.

Note: “Annual” here means a membership year, not a calendar year.

This premium credit card has $550 annual fee. But with the $300 Annual Travel Credit, your actual annual fee can be said to drop down to $250.

3) 10X total points on hotels and car rentals when purchased through Chase Travel℠.

When you purchase through Chase Travel℠, your hotel stay and car rentals will earn you 10X total points (immediately after the first $300 is spent on travel purchases annually.)

Flights? You will earn 5X total points when purchased through Chase Travel℠.

4) Auto Rental Collision Damage Waiver: Primary

Many annual-fee carrying credit cards offer rental car protections when you use those credit cards, but you need to be mindful of the difference between primary coverage and secondary coverage.

Primary coverage here means that within your country of residence, this benefit will apply first in paying out covered theft or damage to your rental; in other words, there is no need to go through your own auto insurance company.

5) Up to $100 credit for Global Entry, TSA PreCheck® or NEXUS

When you use your card to charge the application fee for Global Global Entry, TSA PreCheck® or NEXUS, you will get reimbursement up to $100. This benefit is available every 4 years. With long lines at airports everywhere, I strongly recommend you to get Global Entry membership, whose benefit include a complementary TSA PreCheck®.

Partner site: learn more about this card

2. How best use Chase Ultimate Rewards® points?

With Chase Sapphire Reserve® Card, you earn Ultimate Rewards® points, a highly versatile proprietary rewards program of Chase.

Ultimate Rewards® points have many uses.

To name a few,

1. First, you can use them as if they are cash-equivalents. For instance, you can get statement credit of $100 by redeeming 10,000 points. In this case, the point value is 1 point = 1 cent.

2. If you want extract some more value from your hard earned Ultimate Rewards points, you can redeem them through Chase Travel℠. In this case, your redemption value is 1 point = 1.5 cent, because your points are worth 50% more as a cardmember of Sapphire Reserve® card.

3. Potentially, the best redemption value can be achieved when you transfer Ultimate Rewards points to partner airlines and book premium class award tickets.

As of this writing (June 2024), you can transfer Ultimate Rewards points into airline miles for a total of 11 airlines: United, Air Canada, Air Lingus, British Airways, Iberia, Flying Blue (Air France), Emirates, JetBlue, Singapore, Southwest and Virgin Atlantic.

Among these airlines, Virgin Atlantic, United, Southwest, and British Airways are relatively easier to use.

For example, Virgin Atlantic has an incredible award opportunity with All Nippon Airways. Likewise, Air Canada's Aeroplan is a great option for those traveling with children under 2 years of age.

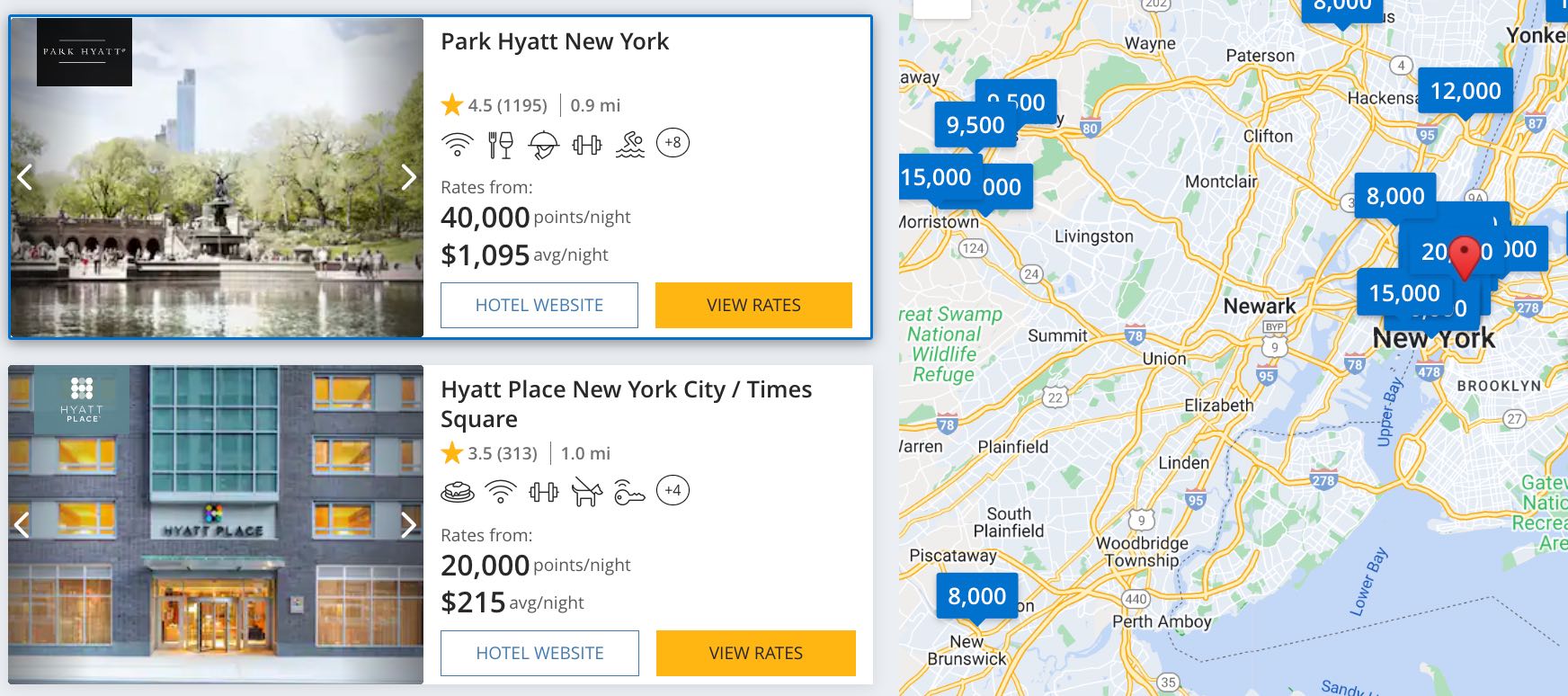

4. Those of you who find airline redemption to be difficult may want to convert Ultimate Rewards points into Hyatt points.

While Ultimate Rewards points can also be transferred to Marriott Bonvoy and IHG at 1:1 ratio, only Hyatt points make financial sense.

For example, a night at Park Hyatt in Manhattan, New York, requires close to $700-$1,000 per night. But if you convert Ultimate Rewards points into Hyatt points, you can do it only with 40,000 points. In this case, your Ultimate Rewards points are valued as high as 2.5 cent per point.