Please be advised that this site includes affiliate links that pay commission and referral links that provide other forms of benefits such miles or points. Should you apply for a credit card and get approved through the links that were provided by this website, it is understood that some form of compensation will be made to the website owner. You can read the full advertiser disclosure here. All information related to credit cards has been collected independently by MileMoa.com and has not been reviewed or provided by the issuers of credit cards discussed here. While the offers mentioned below are accurate at the time of publication, they are subject to change at any time and may have changed, or may no longer be available.

Partner site: Learn more about this product

IHG One Rewards Premier Business Credit Card is a feature-rich business credit card from Chase, which is an ideal choice both for frequent users of IHG properties and for occasional travelers.

In this posting, I first will describe major features of this card. And then I will show how you can top-off Annual Reward Night, an exciting new enhancement of the IHG program.

1. Major Features

IHG One Rewards Premier Business Credit Card has the following major features.

1) Welcome Bonus

After spending $4,000 on purchases in your first 3 months from account opening, you will earn 140,000 Bonus Points.

With variable rates, 140,000 points can be used for a two-night stay at a high-end property, or can be stretched out for a week-long or longer stay at a low-priced property.

2) Anniversary Free Night

Every year after account anniversary, you will earn one Anniversary Free Night at IHG Hotels & Resorts. This Anniversary Free Night can be used for a one-night stay at eligible IHG hotels worldwide (up to 40K points). From this year (2022), you can also use existing points from your IHG One Rewards account to redeem your Anniversary Night at hotels above the 40,000 point redemption level. There is no known cap for this top-off.

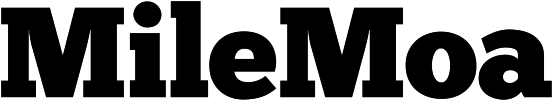

3) Fourth Night Free

As a card member, when you redeem your IHG points for a consecutive four-night IHG® hotel stay, your fourth night will be free. For example, if a night stay at InterContinental Paris Le Grand is 87,000 per night, and you stay four consecutive nights, you will only pay 261,000 points (87,000 x 3), not 348,000 points, thereby saving 87,000 points.

4) Platinum Elite status

As a card member, you will automatically retain Platinum Elite status with IHG (as long as you remain a Premier Business cardmember). Granted that this elite status doesn't offer much in terms of tangible benefits, you may get a better room based upon availability. Also, in most cases, when you check-in, you will be offered a choice between bonus points and drink coupons. While drink coupons sound trifling, in expensive cities such as Paris, one coupon may worth more than 50 euro.

5) Up to $100 credit for Global Entry, TSA PreCheck® or NEXUS

When you use your card to charge the application fee for Global Global Entry, TSA PreCheck® or NEXUS, you will get reimbursement up to $100. This benefit is available every 4 years. With long lines at airports everywhere, I strongly recommend you to get Global Entry membership, whose benefit include a complementary TSA PreCheck®.

Partner site: Learn more about this product

2. Anniversary Free Night

Each account anniversary year, you will earn one Anniversary Free Night certificate.

This certificate has a point redemption cap of 40,000 points, but you can also use existing points from your IHG One Rewards account to redeem your Anniversary Night at hotels that require more than the 40,000 point redemption level.

Because IHG One Rewards Premier Business Credit Card is a new product that debuted in 2022, no one has received an Annual Free Night.

But the way it works should be identical to that of IHG One Rewards Premier Credit Card.

So, below, I have detailed how it works with the IHG One Rewards Premier Credit Card. In this way, you can see how in the future you can use your Anniversary Free Night from IHG One Rewards Premier Business Credit Card.

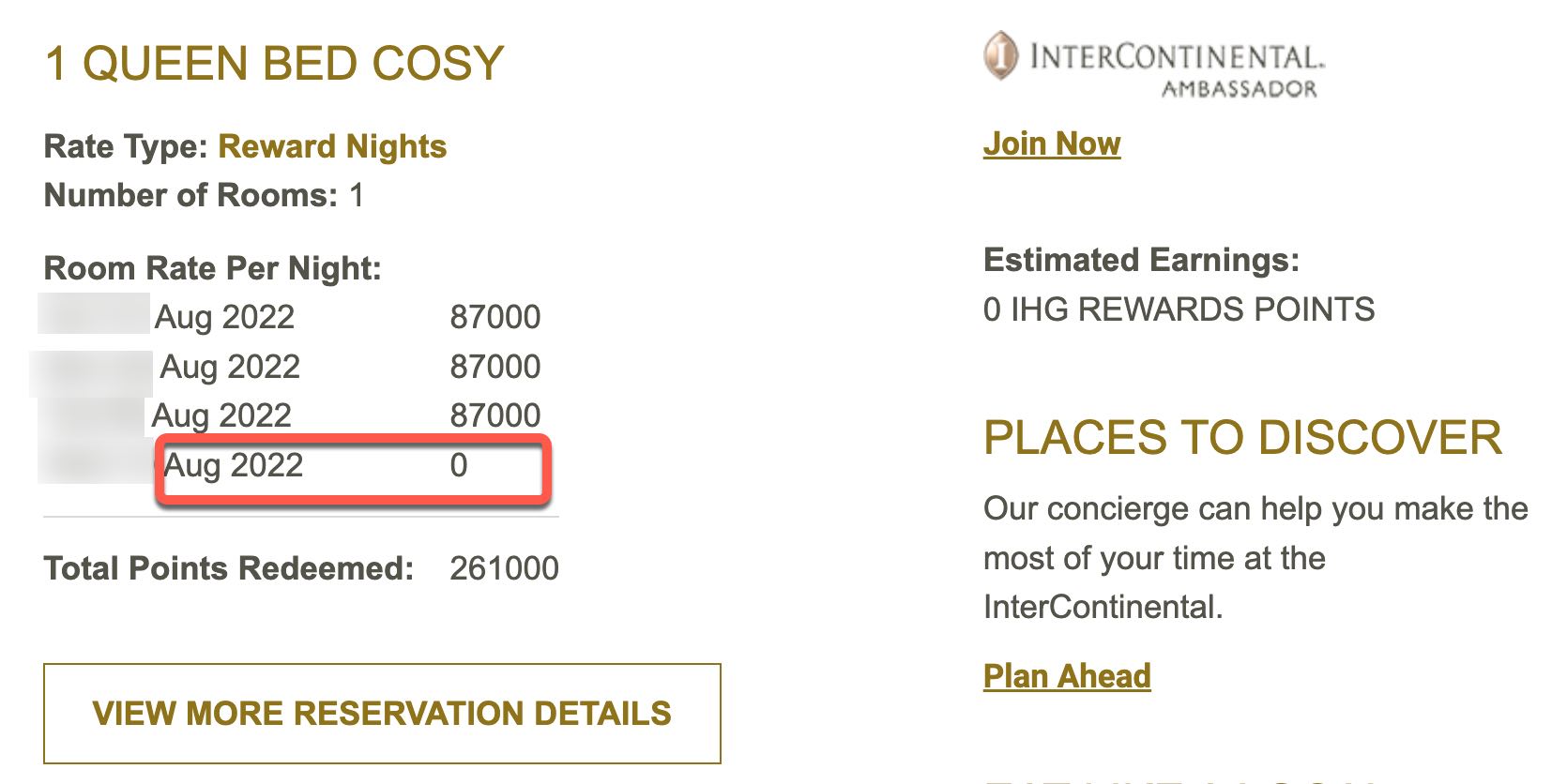

1) First, go to the IHG.com site. Log in. Then click on the IHG One Rewards section in the upper right corner.

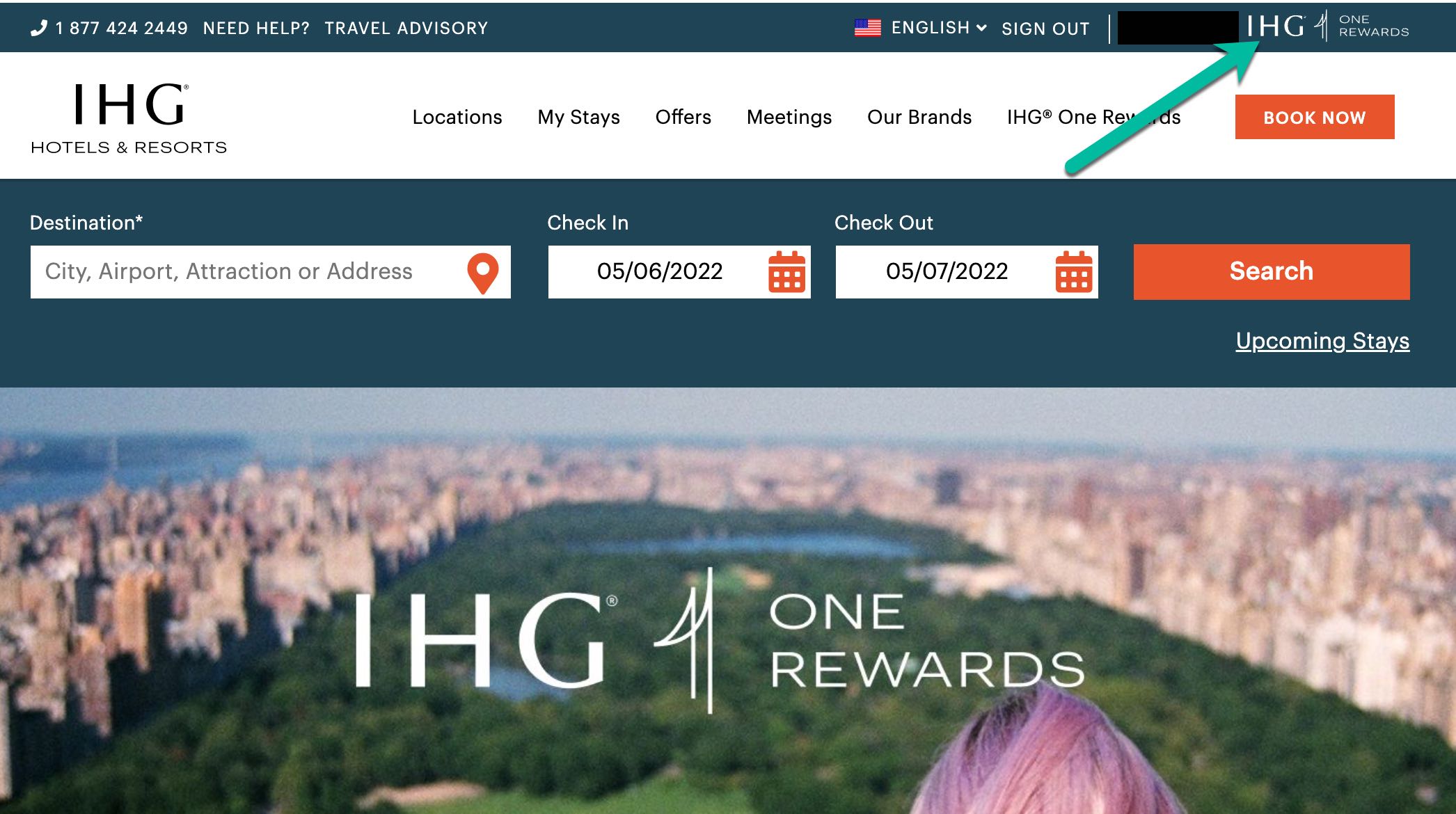

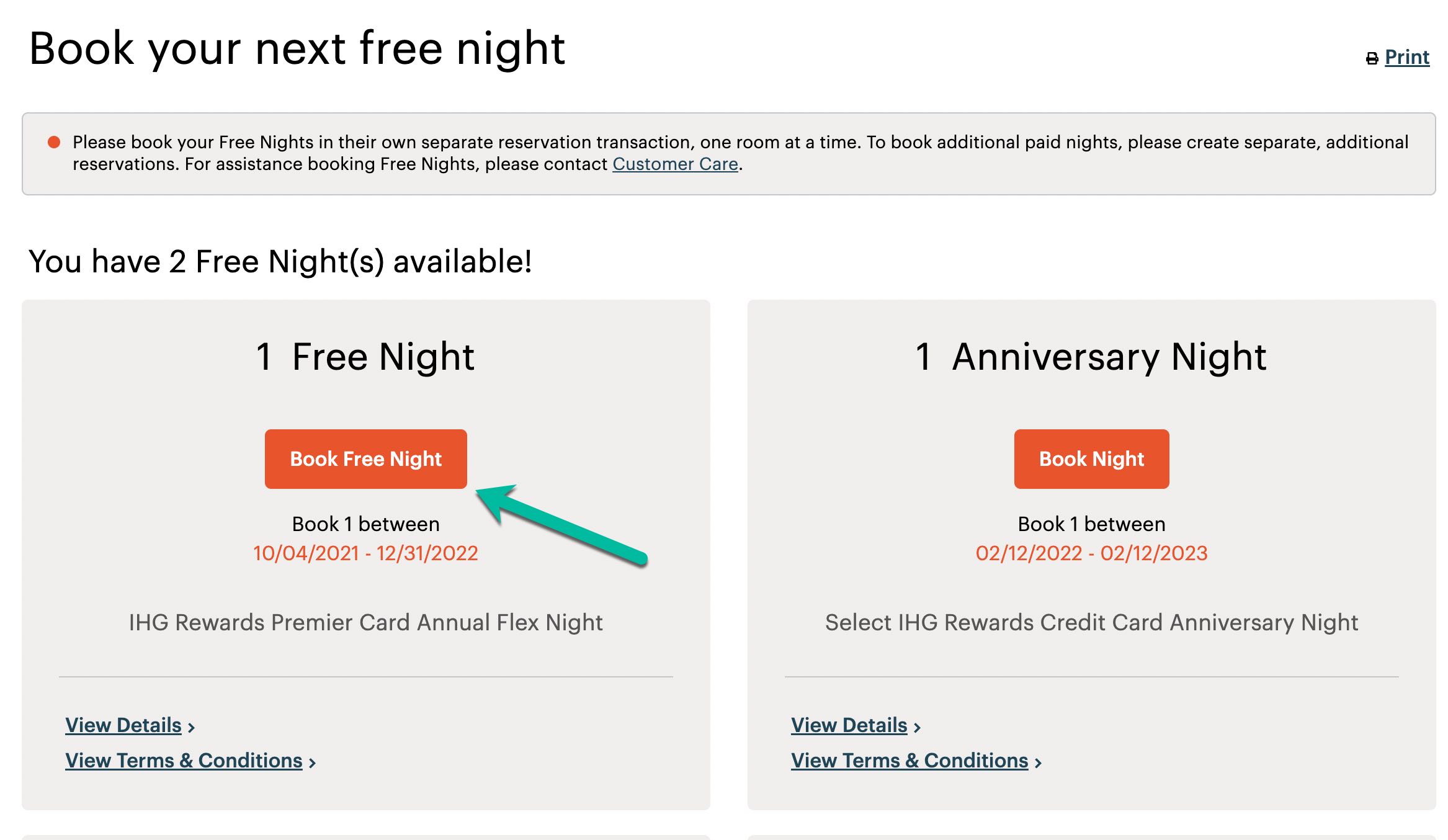

2) Personal account information is displayed. If you scroll down there, you can check the status of your Free Night certificates. Click here for “Book a Free Night.”

3) Press “Book Free Night” of the IHG Rewards Premier Card Annual Flex Night.

Remember here that “Select IHG Rewards Credit Card Anniversary Night” is not available for points top-off.

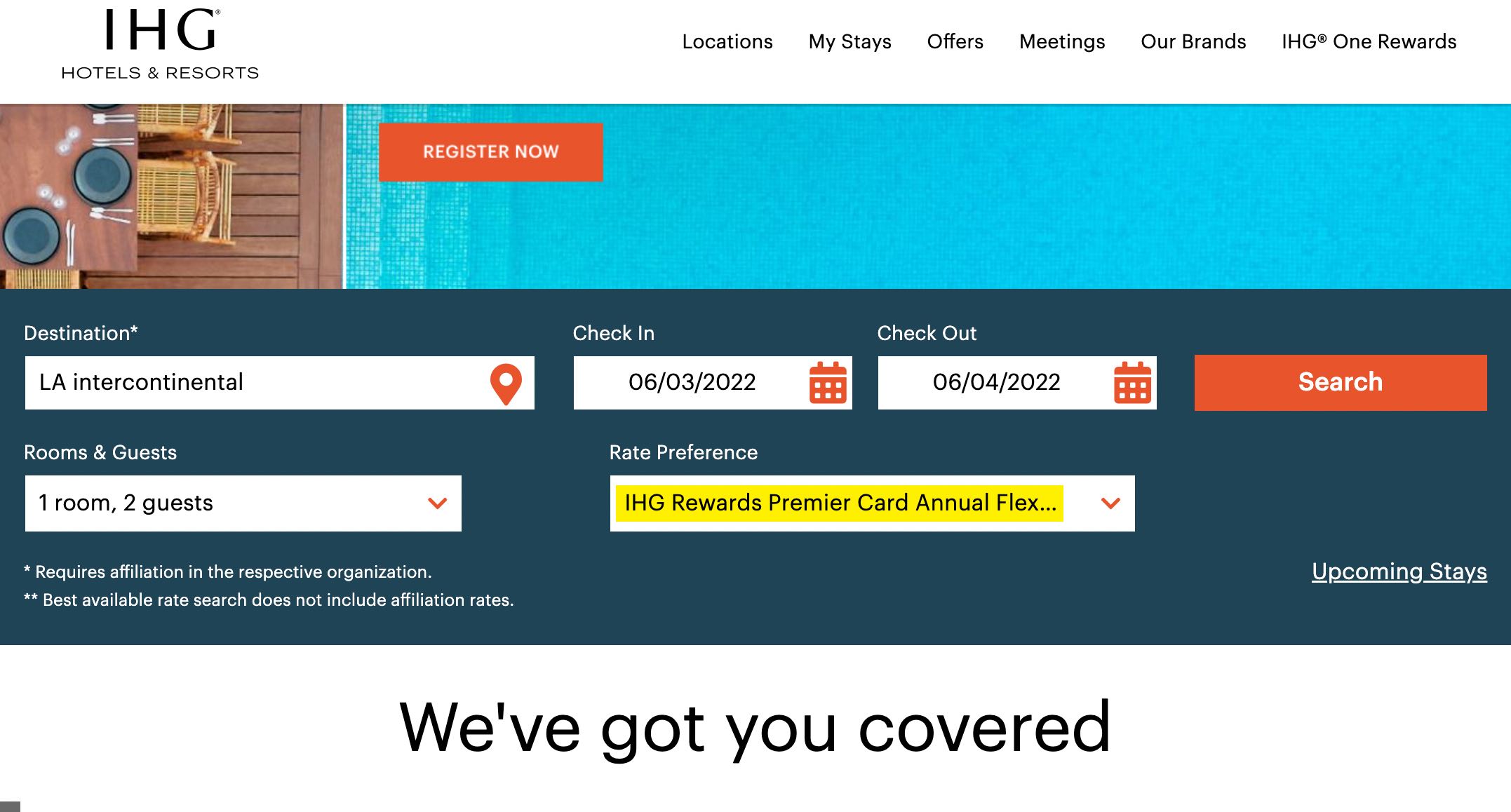

4) Now, the screen is switched back to the main screen, and the Rate Preference section specifies that the selected rate is “IHG Rewards Premier Card Annual Flex..”.

Here, you can enter your desired travel location and date. Then, click Search.

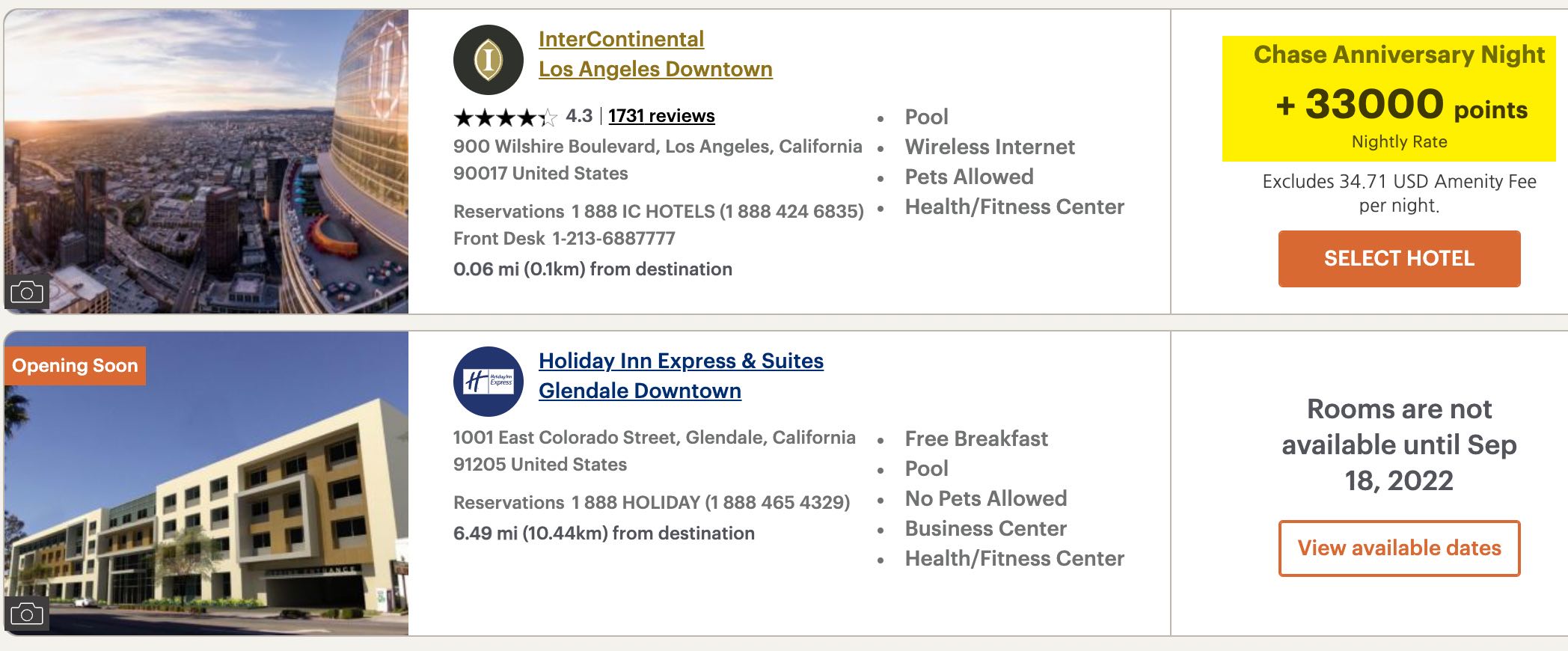

5) Using the LA area as an example, I see that the InterContinental Los Angeles Downtown is available for point redemption.

For the date I searched for, it says that you have to pay 33,000 points in addition to the 40,000 night certificate.

6) When I clicked Select Hotel, I saw that 1 King Bed Classic room is available.

7) And when I go to Select Room and look at the details, I see an option to choose whether to spend all 33,000 points or use some combinations of points and cash. In this case, the point value is calculated at $60 for every 10,000 points, so if you want to save some points, using some cash seems to be the way to go.