Please be advised that this site includes affiliate links that pay commission and referral links that provide other forms of benefits such miles or points. Should you apply for a credit card and get approved through the links that were provided by this website, it is understood that some form of compensation will be made to the website owner. You can read the full advertiser disclosure here. All information related to credit cards has been collected independently by MileMoa.com and has not been reviewed or provided by the issuers of credit cards discussed here. While the offers mentioned below are accurate at the time of publication, they are subject to change at any time and may have changed, or may no longer be available.

Partner Site: Learn more about this card

Ink Business Unlimited® Credit Card is a no-annual fee business credit card from Chase, which allows you to accrue highly valuable Chase's Ultimate Rewards® Points for all your eligible spendings (again, without any annual fee).

In this posting, I will describe major features of this business credit card, and then will explain one often misunderstood feature of this credit card.

1. Major Features

Ink Business Unlimited® Credit Card has the following major features.

1) Welcome Bonus

bonus_miles_full

(But as I will explain in a moment, this bonus cash back will be in the form of Ultimate Rewards Points, which then can be redeemed for cash.)

2) 1.5X earning on all purchases

For every eligible spending, you will earn 1.5 total points per dollar spent.

Sure, there are cards out there that will get you more points for certain specific categories. But do you have time to think through all available options in the market?

Put all your charges on Ink Business Unlimited® Credit Card and focus on your more important business strategies. Over time, you will have better outcomes.

3) No annual fee

When it comes to your own personal credit cards, you may jump from one credit card to another chasing the best possible points accruals.

But when you get a business card, you need to think about long-term commitments. In this respect, getting a no-annual fee business card is a better choice for most business owners.

Partner Site: Learn more about this card

2. Did you know?

Ink Business Unlimited® Credit Card is categorized as a business card that offers a cash back based upon your business-related spendings.

But did you know that you actually earn Ultimate Rewards points (Chase's proprietary rewards points) rather than cash?

A new cardmember will “bonus_miles_full”

But instead of getting outright cash, you earn Ultimate Rewards Points, which of course has many more (and often more useful) options than a cash redemption.

For example, if you also hold Chase Ink Business Preferred® Credit Card, you can combine your Ultimate Rewards points from Ink Business Unlimited® Credit Card into those of Chase Ink Business Preferred® Credit Card.

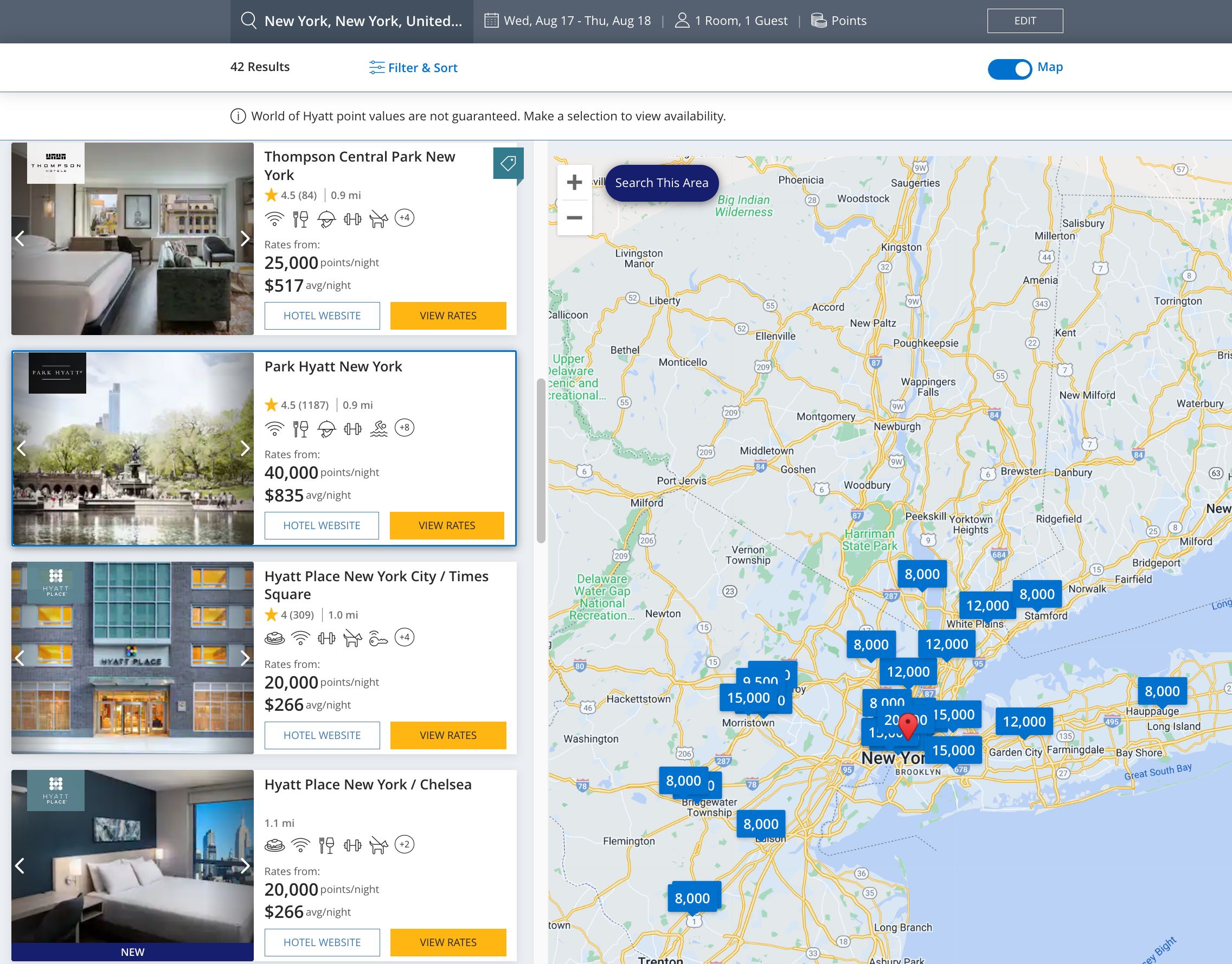

And because Ink Business Preferred® Credit Card has the feature of transferring points to leading frequent travel programs at full 1:1 value, you can transfer Ultimate Rewards points to Hyatt's World of Hyatt Program at 1:1 ratio.

Hyatt points are valuable, and you can redeem 40K Hyatt points for a one-night stay at Park Hyatt New York, which retails in the range between $800 and $1,000.