Please be advised that this site includes affiliate links that pay commission and referral links that provide other forms of benefits such miles or points. Should you apply for a credit card and get approved through the links that were provided by this website, it is understood that some form of compensation will be made to the website owner. You can read the full advertiser disclosure here. All information related to credit cards has been collected independently by MileMoa.com and has not been reviewed or provided by the issuers of credit cards discussed here. While the offers mentioned below are accurate at the time of publication, they are subject to change at any time and may have changed, or may no longer be available.

Partner Site: Learn more about this product

United Quest℠ Card is a feature-rich consumer credit card from Chase, which is an attractive choice both for frequent flyers of United Airlines and for occasional travelers flying on Star Alliance partner airlines.

In this posting, I will describe major features of this card, and then will explain one important benefit that comes with the credit card, an access to XN booking class of the United Airlines.

1. Major Features

United Quest℠ Card is a mid-level personal credit card (of four varieties of the United-affiliated credit cards for consumers) and has the following major features.

1) Welcome Bonus

After spending $4,000 on purchases in your first 3 months from account opening, you will earn 70,000 bonus miles as well as 500 Premier qualifying points.

2) Up to a $125 United® purchase credit (Terms apply)

Each account anniversary year, you will receive up to $125 credit on United® purchases. Unlike airline fee credit of some other credit cards that are applicable only for incidental charges such as baggage fees, this $125 credit works also on your airfare as long as you charge your United purchases to your card.

According to offer details, qualifying United purchases include airline tickets purchased from United and the following purchases made from United: seat upgrades; Economy Plus®; inflight food, beverages and Wi-Fi; baggage service charges or other United fees.

Note, however, that other United related purchases, such as United Cruises®, United MileagePlus X, DIRECTV® and Merchandise Awards, are excluded, and United tickets booked through some discount travel websites or as part of a third-party travel package will also not qualify.

3) Free Checked Bags

When you purchase your United airline tickets with this credit card, you will get first and second standard checked bags free, and this benefit is also applicable to one traveling companion on the same reservation.

While this benefit is only available on United- and United Express-operated flights (not eligible for codeshare partner-operated flights), this feature can save you up to $360 per roundtrip (terms apply).

4) Up to 10,000 miles in award flight credits each year (Terms apply)

From your second year of card membership, you will get 5,000 miles back in your MileagePlus® account after you take a United® or United Express–operated award flight booked with your own miles. This will be in the form of Award Flight Credit, and you can get up to 2 times every anniversary year.

5) Up to $100 credit for Global Entry, TSA PreCheck® or NEXUS

When you use your United Quest℠ Card to charge the application fee for Global Global Entry, TSA PreCheck® or NEXUS, you will get reimbursement up to $100. This benefit is available every 4 years. With long lines at airports everywhere, I strongly recommend you to get Global Entry membership, whose benefit include a complementary TSA PreCheck®.

Partner Site: Learn more about this product

Do you know XN booking class?

United Quest℠ Card has several highly important benefits such as the primary rental car collision damage waiver.

But, what makes this card a must-have is that it gives you access to XN fare, an additional inventory for United elite flyers or cardholders of United partner credit cards. extra mileage seat called

Before explaining the usefulness of XN, I think I should first explain the concept of booking class / fare class.

So, what is a booking class or fare class?

Even with the same economy-class ticket, there is a huge price difference depending on several factors such as the length of the ticket validity and the flexibility of schedule change. In other words, it is the same economy seat when boarding an airplane, but the price is different depending on the purchase conditions.

And this difference is mainly indicated by the alphabet. So, Y is a full-fare economy ticket, B is a flexible economy ticket, and so on.

For United Airlines,

- The default fare class for business award seats is I

- The default fare class for economy award seats is X

- And, the code XN is assigned to extra availability, which is reserved only for United's elite members.

To use an analogy, you can understand that XN is like a reserved spot that store owners set aside for store regulars.

Fortunately, if you are a cardmember of the Chase-issued United-affiliated credit card affiliate, you can access the XN fare class.

And, the availability of this XN fare literally makes a huge difference.

Let me give you an example.

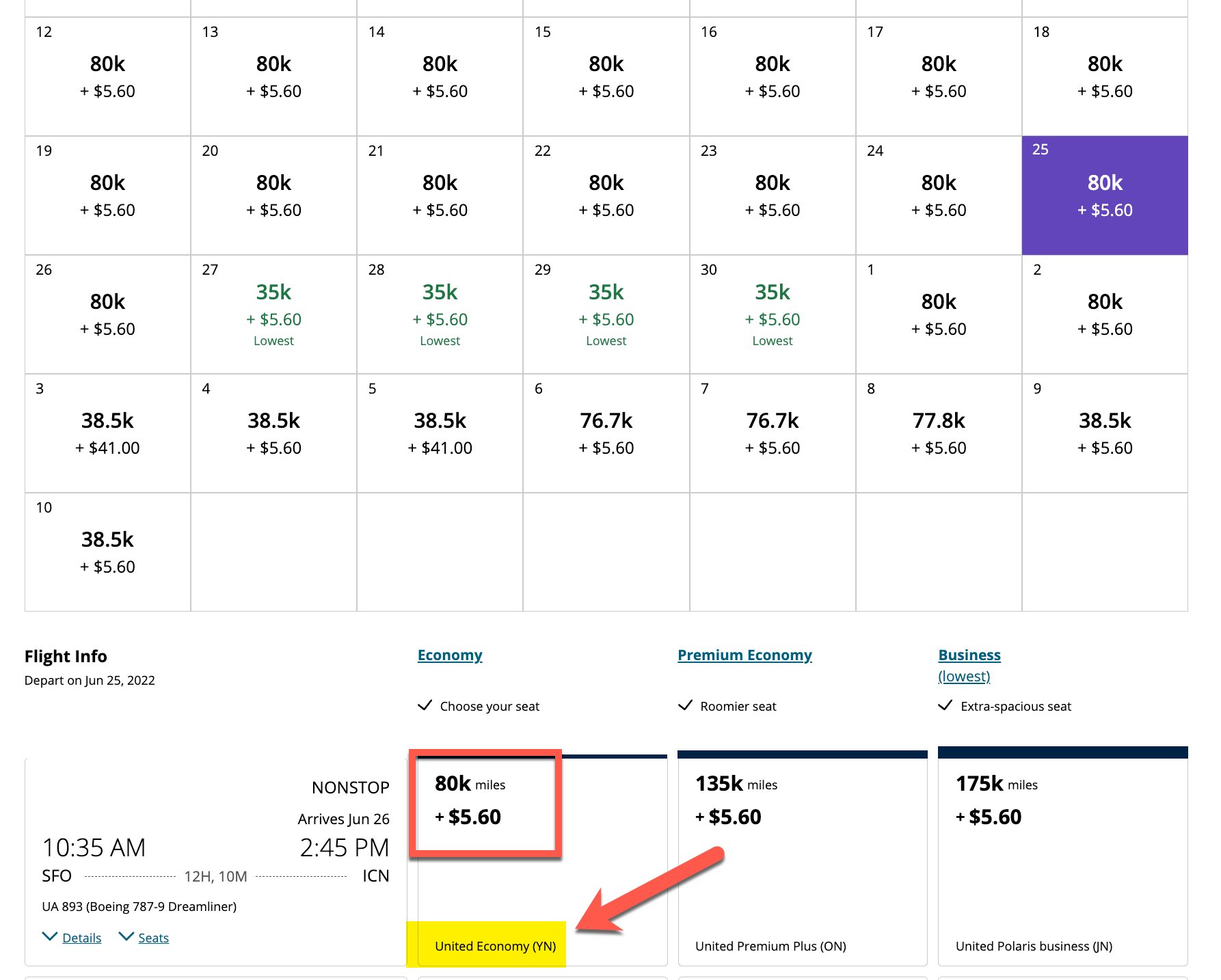

A family of three would like to purchase tickets for UA 893, a San Francisco-Incheon non-stop flight, that departs on June 25.

If a member of the family holds a United-affiliated credit card and redeems United miles from his/her account, they can need only 35,000 miles per person thanks to the access to XN fare.

Do you see the phrase “Exclusively available to you as a MileagePlus Cardmember”?

In this case, 3 tickets = 105,000 miles.

However, if you do not have a card, you cannot access XN. On this day, X fare seats are all sold out, and only YN fare is available. And, because YN fare is essentially an unrestricted economy fare, it requires a whopping 80,000 miles per person. In other words, you need to redeem altogether 240,000 miles for 3 tickets.

It's the exact same flight, exact same seat, but there's a difference of 135,000 miles depending on whether you have one credit card or not.

Therefore, if your family is going to Korea during peak season, a United-affiliate credit card is a must.